Background

Customers regularly turn to Cint to help them source tightly defined sample from specific geographic regions often underserved by other market research systems. When we sat down with Umar Akhtar and Mihajlo Popesku, co-founders of Qudo, we discovered that their business depends exclusively on Cint to provide them with abundant sample from just about anywhere in the world.

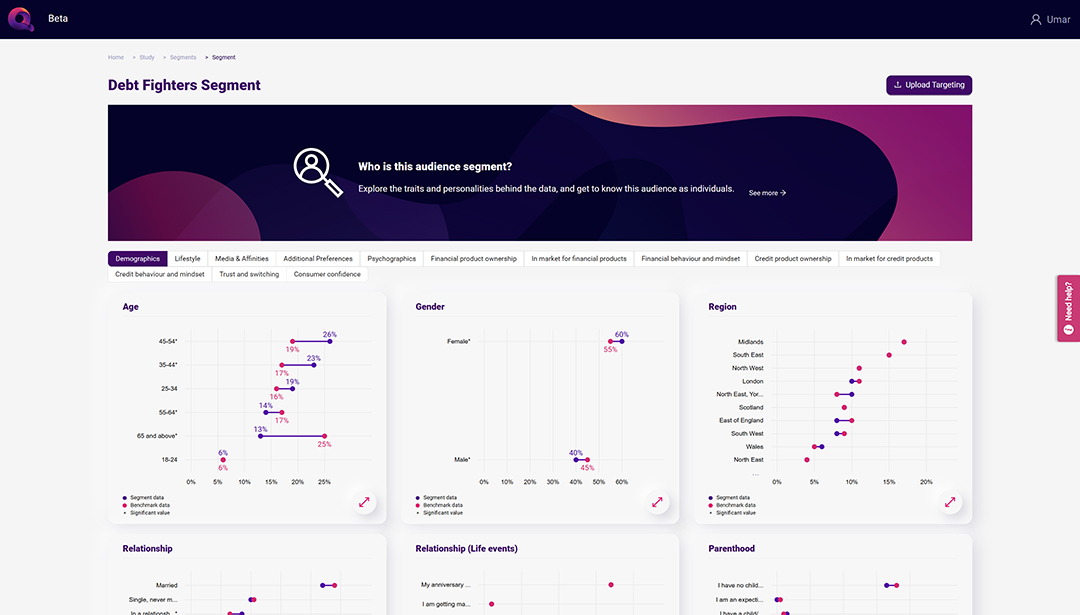

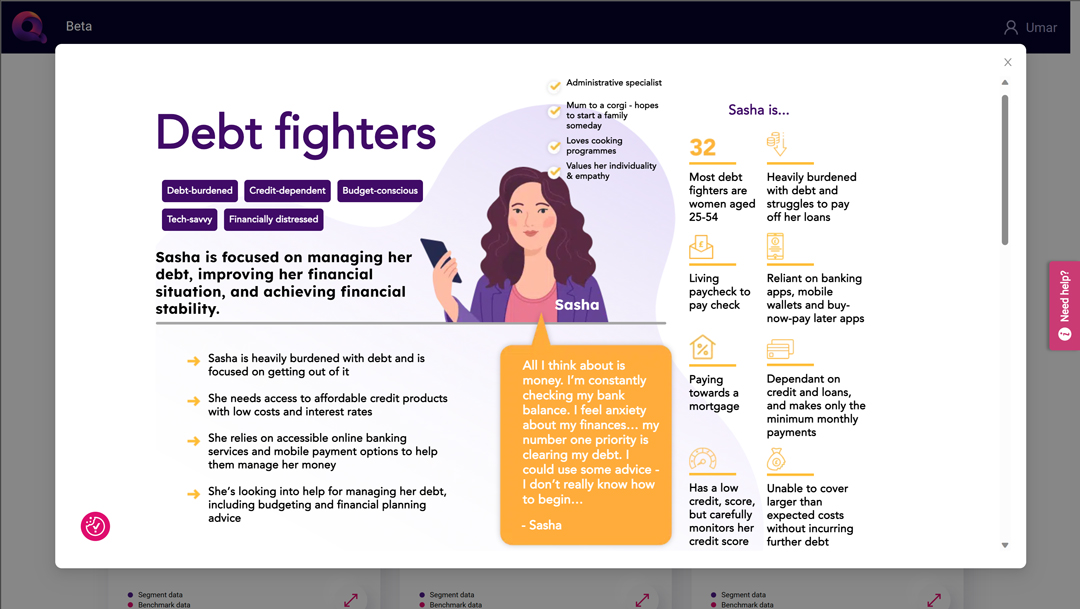

Qudo focuses on market validation, market segmentation, and precision segment activation. Their foundational principle is that insights must translate into tangible business value; data that is actionable. Cint survey data is another foundational pillar of their business. Qudo’s cloud-based market research and digital activation platform consistently provides clients with precise audience targeting on digital media channels – all powered by Cint’s quality sample.

The Qudo team first consults with their clients to determine campaign relevant sectors to target. Using Cint’s quality sample, Qudo segments audiences that correspond to the specific sectors and matches them to audience criteria unique to a chosen social media platform.

Umar shares, “Qudo’s Precision Activation Engine builds segments based on high quality, zero-party Cint data that allows us to understand the drivers behind consumer decision making.”

Qudo leverages Cint to power its Precision Activation Engine, an AI powered segmentation engine designed to identify and activate new and existing audience segments. Each segment is built using thousands of statistically significant data points unique to them. The data points can then be uploaded to channels like Facebook, YouTube, and TikTok with a few clicks making campaign activation easy. What’s more, clients are armed with an arsenal of content insights designed to motivate each segment to take action. The results of this approach are conversion rates of between 3x and 6x vs traditional methods.

The Challenge

A leading bank client in Serbia enlisted Qudo to help them bring focus to an initially untargeted online loan product launch that had stalled. Qudo had to identify new niche segments, achieve higher conversion rates, and justify the marketing ROI through precision targeting of specific social media audiences. Since Mihajlo had used Cint data before co-founding Qudo, he knew he could get the job done.

Beyond the potential challenge of deriving adequate coverage from a smaller country, Qudo further narrowed their respondent qualifications by; their position in the buyer journey, household personas, various socio-demographics, and past purchasing behaviors.

They also had to successfully ask respondents questions about conducting financial transactions online, which for many, raises issues around privacy and security. In addition, relying on banks is not as much a cultural norm in Serbia as it is in western countries.

From this niche audience, Qudo hoped to gather enough data to successfully map the resulting insights to specific audience profile criteria available on different social media platforms.

The Solution

Qudo worked with the client to understand their challenges and “what success looks like” before first helping the bank design a questionnaire to profile and ultimately field respondents based on:

- Financial needs and priorities

- Borrowing patterns

- Lifestyle

- Media consumption

- Psychographics

- Demographics

- Socio-economics

Once in the field, Qudo’s API integration with Cint leveraged respondents from more than 30 panels. Despite an 18% incidence rate of eligible respondents, Cint delivered a sample of 1,500 completes within the first week.

The Qudo dashboard allowed the client to follow the top line fielding results and quota completion in real-time. Once the sample was collected, Qudo’s AI-powered segmentation engine identified the driving characteristics of four distinctly relevant target segments. With the rich insights gleaned from Cint data, Qudo advised the bank on tone, content, and messaging for new campaigns directed at each of the segments identified using Qudo’s Precision Activation Engine. Once everything was ready, the digital campaigns were launched.

“Cint data helps us discover who we need to target and what we need to say to them in order to position a client’s product or service in the optimal way.”

Umar Akhtar, Qudo

Results

Qudo had the bank run the Cint powered campaign in tandem with their original campaign and the success metrics of the Qudo campaigns speak for themselves:

- 49% higher reach

- 60% more impressions

- 127% more clicks

- 472% more landing page views

- 69% cost savings per click

And most impressive of all, the actual conversion rate for new loans increased from 25% on the old campaign to 72% powered by Cint data and Qudo’s targeting engine