The Size of Prize

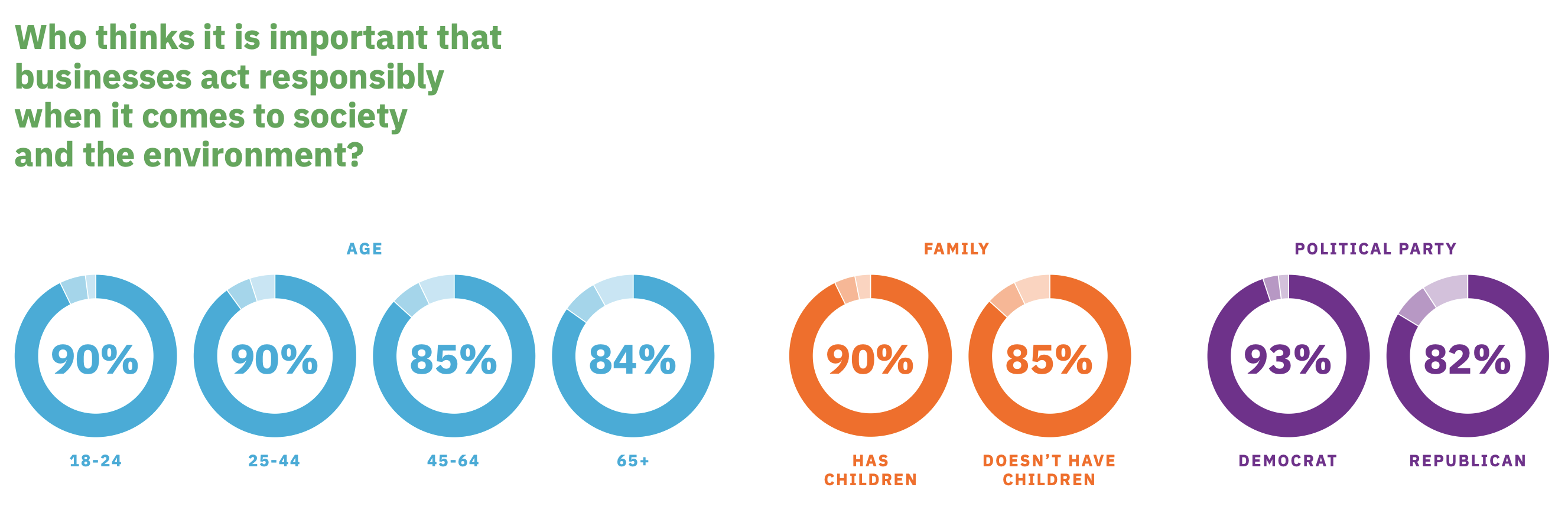

According to Glow’s The Size of Prize report released in March 2024, a $44 billion opportunity is up for grabs for brands who wish to offer more sustainable alternatives. In the report conducted in November 2023, research technology company Glow, in collaboration with Triple Pundit, 3BL, and Cint surveyed 3,000 US adults with the aim to understand how sustainability impacts their purchasing decisions. According to the research, 87% of US consumers found it important (on varying degrees) that businesses acted responsibly towards society and the environment. Only 3% did not find it important for businesses to act responsibly. When exploring which demographics placed more emphasis on businesses acting responsibly, there was a clear upward trend towards younger generations. People with children as well as democrats also displayed a higher inclination for this need. Some highlights from the report include:

Some highlights from the report include:

Brand switching:

- Of 12 industries analyzed, the top three were food and grocery ($9.4 billion), general insurance ($8.4 billion), and pension funds ($6.2 billion). This represents the dollar figure value of switching to a brand that has a more positive impact on people and the planet.

Breakdown of value by industry:

- More than $16 billion: Food and grocery sector (including food and grocery, liquor products, quick service restaurants, and grocery retailers).

- More than $17 billion: Financial services (including pension funds, banks, and general insurance).

- Nearly $5 billion: Discretionary spending (including airlines, car and automotive, and fashion retailers and brands).

- More than $6 billion: Essential spending (including energy providers and telecommunications).

Influence:

- Media – both social (39%) and news or business (38%) play a huge role in influencing consumer perception of how socially and environmentally responsible a brand is, but topping the list with the biggest impact is word-of-mouth from friends and family (41%).

- Interestingly, when we break down the data demographically, we can observe a notable difference in influence by generation. 50% of Gen Z (18-24) and millennials (25-44) attribute their view on a brand’s sustainability creditials on ‘Social media’. This percentage falls to 36% for Gen X (45-54) and even further to 27% for babyboomers (55 and older).

- This trend reflected conversely when looking how influence comes from ‘News and Business media’.

Drivers of consumer purchasing:

- Cost (49%) played the biggest impact when it came to influencing buying decisions for consumers. Almost half of people surveyed cited the current economic climate as the reason for not making a sustainable purchase.

- Trust (33%), performance (21%), and importance (19%) were other factors that held consumers back.

Actions taken by consumers:

- 70% of consumers surveyed claimed to have actively decided against purchasing a product because they didn’t need it.

- 63% actively reduced food waste.

- 62% utilized household energy saving actions

- 60% shopped at a second-hand store

The MARCO New Consumer Report

The second report we are exploring is the 3rd Global MARCO New Consumer Report 2024. This was conducted between December 2023 to January 2024, and analysed consumer trends across 11 key markets (Brazil, France, Germany, Italy, Mexico, Morocco, Portugal, South Africa, Spain, UK and USA), with a total sample of over 7,000 consumers. Among topics covered around artificial intelligence (AI) and work culture, it also delved into brand commitment and sustainability issues. Some key findings from the report:- On a scale of importance from 1-10, what did consumers find most important for brands to take a stance on? Fighting climate change (7.99), fighting racial discrimination (7.89), fighting poverty (6.85), fighting gender discrimination and gender violence (6.55), and supporting LGBTQIA+ diversity (5.39) came out on top.

- Of less importance were topics like fighting democracy (5.06), supporting the national economy (4.80), promoting learning and upskilling (3.77), promoting mental health (3.67), and promoting a healthy lifestyle (3.13).

- 46.27% frequently use ride-sharing options.

- 58.18% often buy second-hand products.

- 46.27% thought recycling was useful for the conservation of natural resources.

- 58.18% think electric cars are a good solution for protecting the environment.