Categories

Introduction

On behalf of the entire Cint team, I’m pleased to share that our SEK 596 million Rights Issue ($60m or €55m) was successfully completed.

Interest in the rights issue exceeded expectations, with demand oversubscribed by 60%, signaling strong confidence in our financial foundation and the long-term value we provide to customers.

This outcome improves our financial foundation, strengthens our balance sheet, and gives us the resources and flexibility needed to execute on Cint 2.0.

Reinforcing our vision

Cint is a global leader in research and measurement technology. We exist to provide the infrastructure behind digital research. Just as AWS (Amazon Web Services) powers cloud computing, we aim to serve as the rails for consumer insights: automated, scalable, and globally accessible. Over the past year, we’ve taken deliberate steps to unify our platforms, integrate key acquisitions, and refocus our commercial model. That work is progressing well, and this Rights Issue reflects strong stakeholder support for our strategy and future direction.

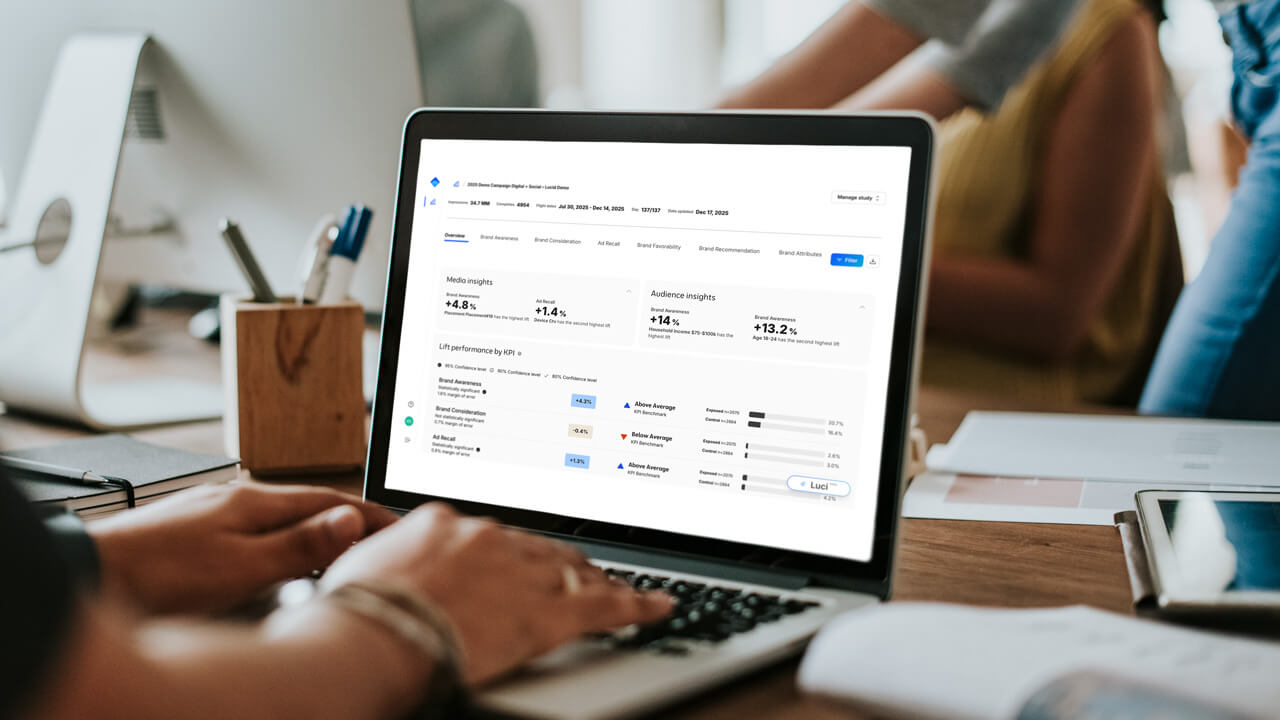

While our Exchange business remains critical to that strategy, we also see strong momentum in media measurement. This growth underscores our value: fast, actionable campaign insights delivered with precision and scale. We’re helping customers optimize performance in real time across platforms and markets. With this capital, we’ll accelerate those capabilities and continue advancing toward outcomes-based measurement.

Why we raised capital

This raise isn’t a bridge, it’s an accelerant for our transformation.

Cint 2.0 is our three-year plan to rebuild and future-proof digital research. In 2025, we’re focused on consolidating platforms and driving operational discipline. In 2026, we pivot to innovation, expanding our measurement capabilities, deepening AI-driven insights, and launching products that meet evolving market needs. By 2027, we aim to deliver a fully automated, trusted platform that becomes the default infrastructure for digital insights at scale.

We’re directing this capital into three customer-centric areas:

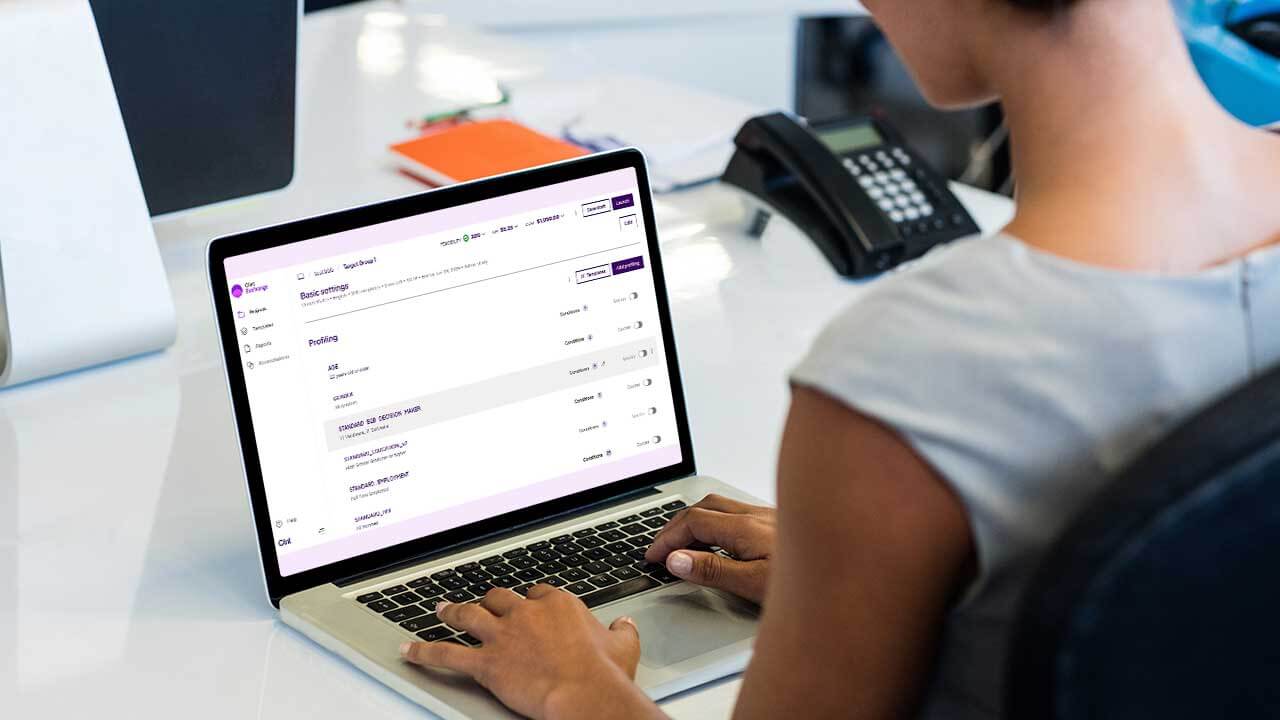

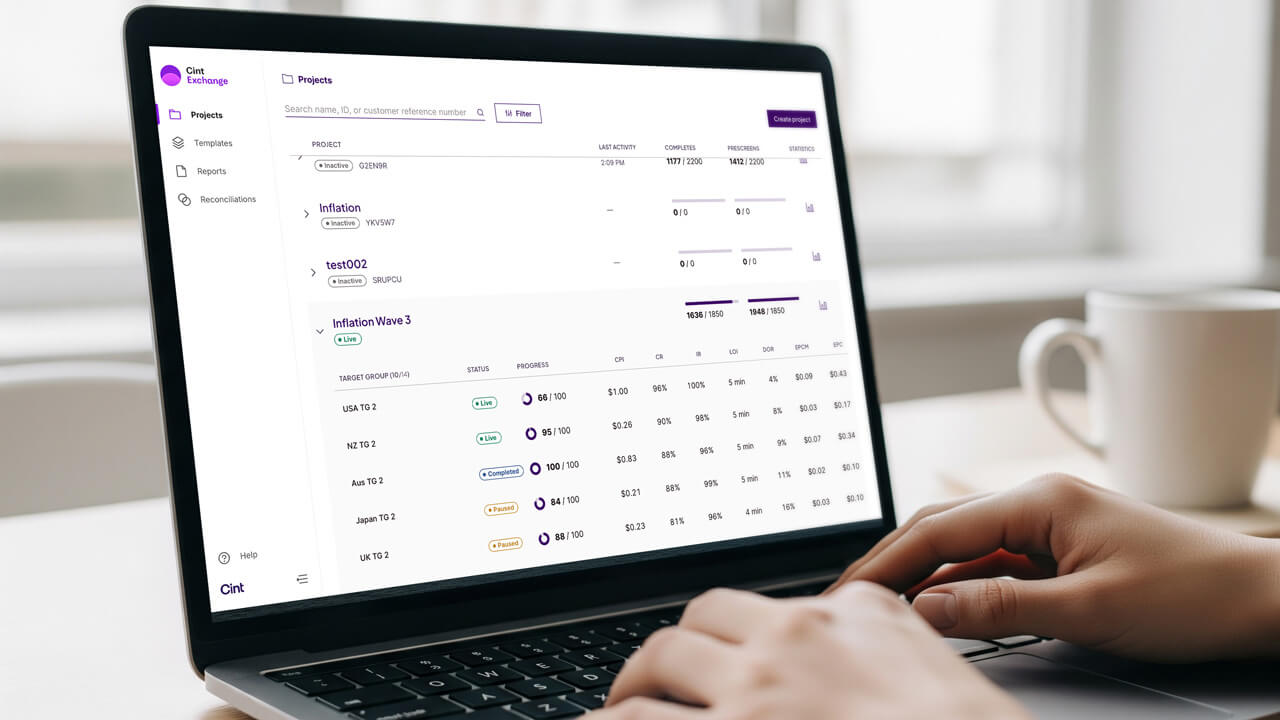

- Platform migration – Moving customers to the unified Cint Exchange for improved automation, efficiency, and consistency.

- Media measurement – Expanding brand lift solutions through AI, broader coverage, and cross-platform capabilities.

- Innovation – Investing in data licensing, synthetic data, fraud prevention, and improved user experience.

Alongside our three core investment areas, the Rights Issue delivers additional benefits that directly support our customers’ success and confidence in our long-term partnership. It significantly improves our balance sheet, reducing leverage from 2.5x to approximately 1.0x, well below our long-term target, providing greater stability and flexibility in a dynamic market. We’re also doubling down on sample quality through our proprietary Trust Score, which ensures consistent, transparent, and reliable respondent performance. In addition, we’re accelerating automation across workflows to increase speed, reduce costs, and scale delivery for customers globally.

Thank you

To our shareholders: thank you for your continued trust. Your support enables long-term focus and responsible growth.

To our customers: thank you for your patience during the platform migration. We know our platform is essential to your work, and we remain committed to delivering reliable, efficient, and forward-looking solutions.

To our team: your dedication and focus are what drive our progress. Together, we are building something lasting.

As a Swedish-listed company operating on a global stage, we value transparency, collaboration, and long-term thinking. This successful raise affirms our direction and strengthens our ability to deliver on it.

Feeding the world’s curiosity, together.