Categories

Introduction

The year 2025 has unfolded against a backdrop of significant global upheaval. From pivotal elections to evolving policy landscapes and persistent inflationary pressures, the economic environment is in a constant state of flux, profoundly impacting how consumers manage their finances, live their lives, and ultimately, spend their money.

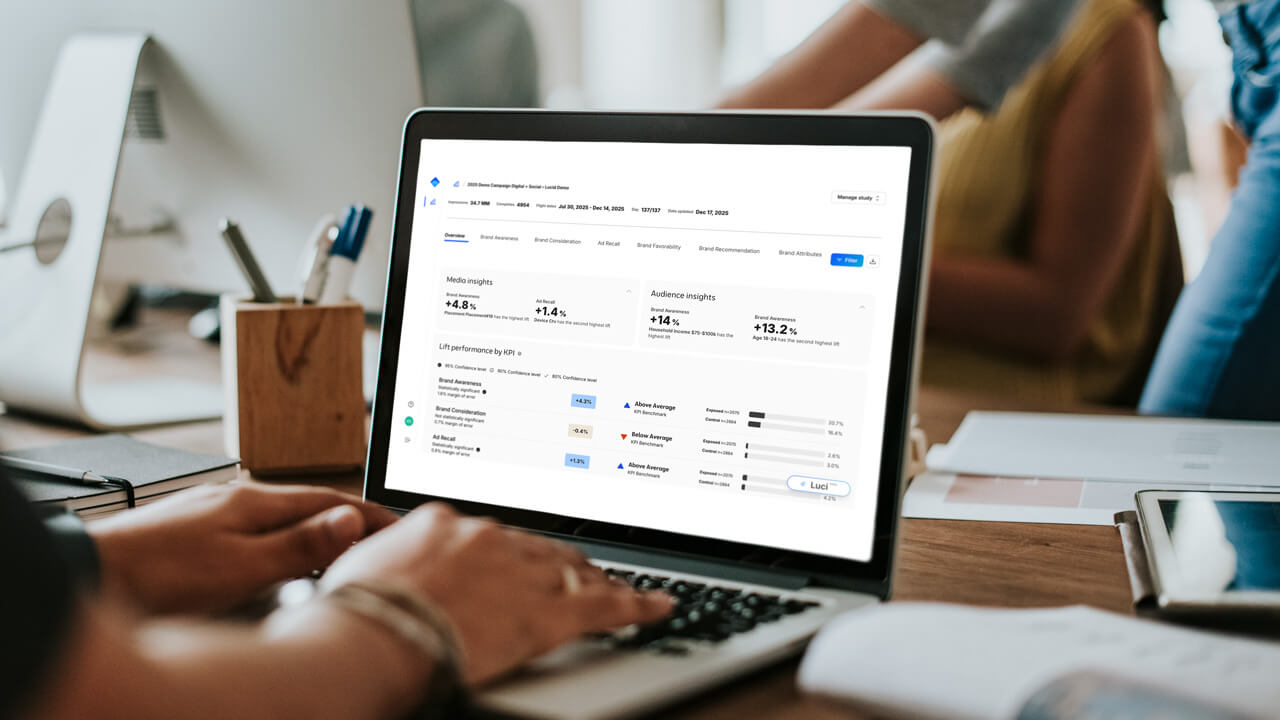

Our latest report dives deep into these radical shifts, offering a vital snapshot of consumer resilience and adaptation in this uncertain period. We explore the multifaceted ways in which individuals across various global regions are navigating the challenges posed by economic instability. This isn’t just about headline figures; it’s about understanding the real-world implications for everyday people.

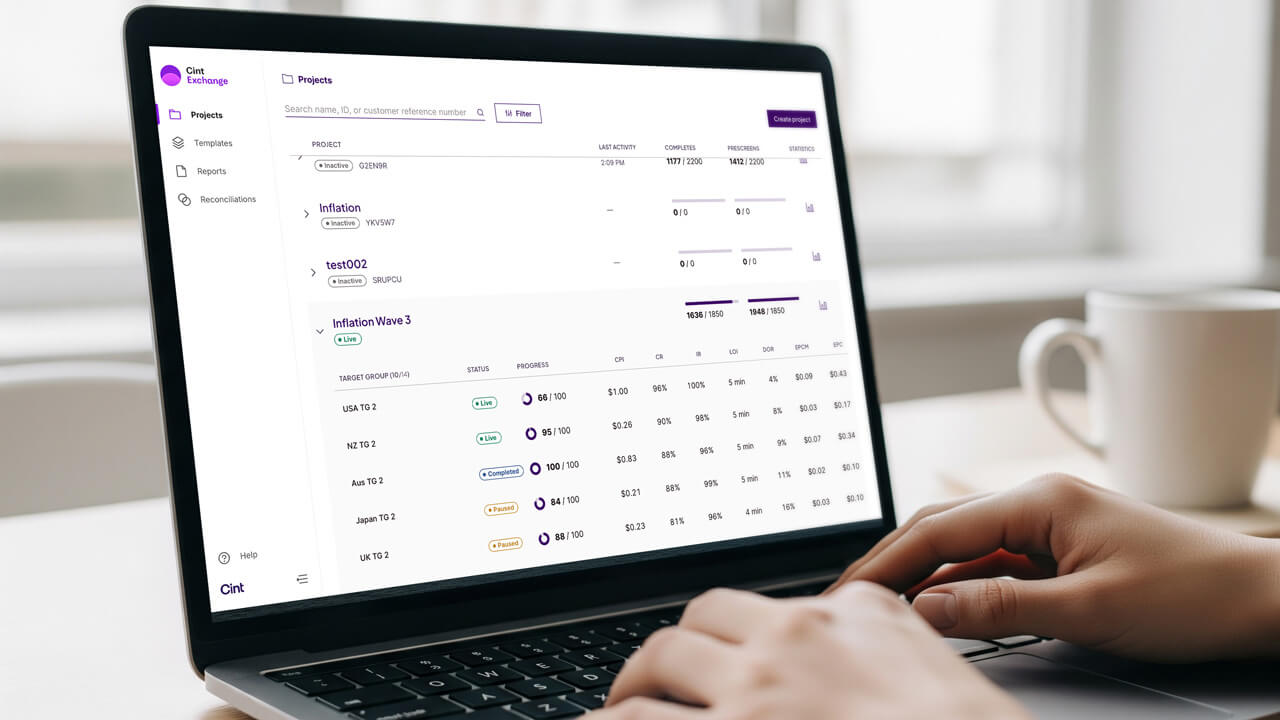

Methodology

The report examines key aspects of consumer financial well-being. We investigate people’s capacity to save amidst rising costs, assess the fluidity of their current housing situations, and shed light on the fluctuating purchasing power for essential groceries. The findings provide a compelling narrative of an unstable moment in time, revealing how households are recalibrating their priorities and strategies.

To gather these critical insights, Cint surveyed respondents across a diverse range of markets, including ANZAC, Japan, Singapore, Sweden, the United Kingdom, and the United States. Their collective experiences paint a comprehensive picture of the global consumer landscape in 2025.

Read the report in full

Curious to understand the full extent of these shifts and their impact? Head here to access the complete report and uncover the detailed findings.