Should you translate international surveys?

It’s a question we hear all the time: “Do I really need to translate my international surveys?”

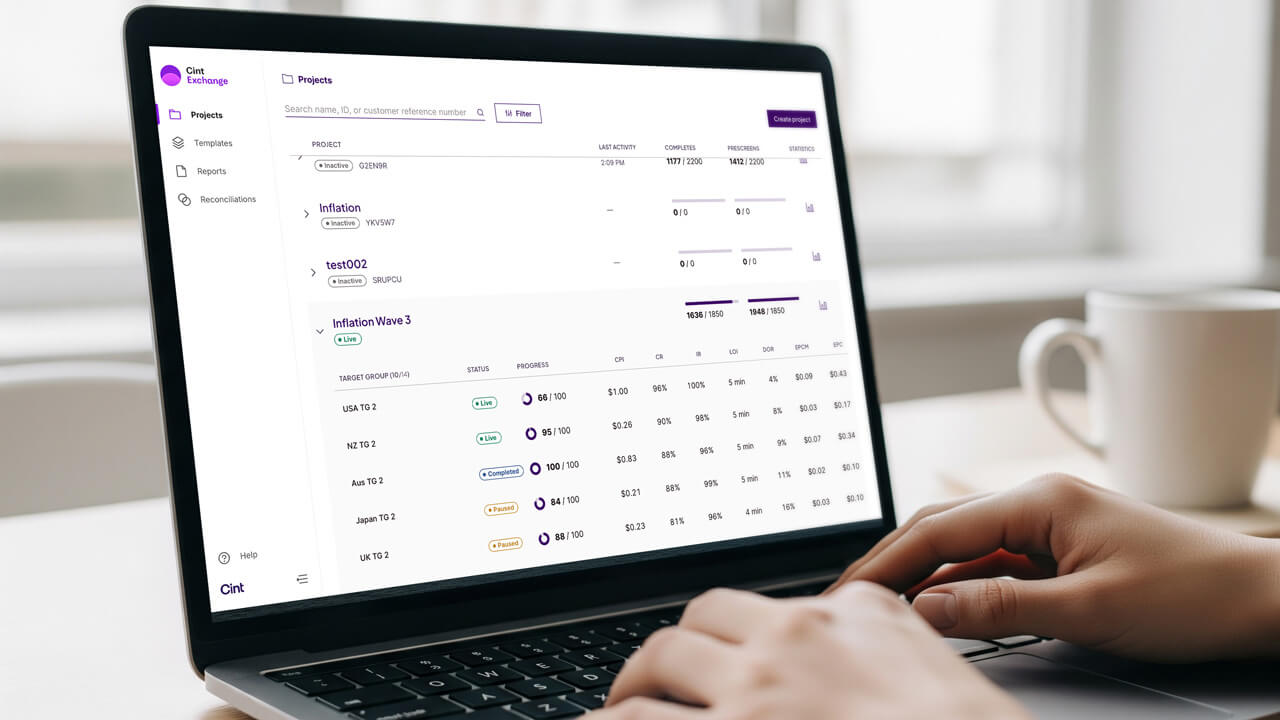

Lucid has partnered with

Fluently, an industry-leading translation company, to provide a thoughtful answer to that question. Together, we will explore international translation best practices in detail. Our goal is to help multinational market research customers best utilize their budget to secure the most insightful data.

We’re going to address the importance of translating surveys to optimize respondent comprehension to provide an overall better experience for the respondent and render better results for you, the researcher.

The importance of survey translation is crucial to emphasize — it matters for both your survey respondents’ experience and the quality of survey results. If you plan to target global markets, you should translate your international surveys. The benefits of transcribing your questionnaires include:

- Broader market: Surveys in multiple languages reach a wider range of individuals, so you can collect high-quality data from a bigger, more diverse audience.

- Better data accuracy: When your respondents can take your survey in their preferred language, they’ll understand the questions better and can give accurate answers.

- Improved respondent experience: When a survey is translated to a respondent’s native language, they are more likely to have a positive experience answering it.

Non-English completes increase each year

Over the last five years, Lucid has seen massive growth in international completes — which also means an increase in studies where English is not the primary language. As you can see, our Marketplace average of non-English completes in 2016 was less than 5 million. Today, we’re seeing those numbers more than double with over 10 million non-English completes in 2020.

The following list shows the languages that have grown more than 25% year over year for both Lucid and Fluently:

- Arabic

- Chinese Traditional

- Dutch

- German

- Hungarian

- Japanese

- Kannada

- Korean

- Polish

- Russian

- Slovak

- Spanish

- Thai

- Vietnamese

With these growth trends, we want to settle the score once and for all regarding translations: are they simply nice to have in market research, or are they actually a requisite for sound international research?

Understanding translation vs. localization

To start, we want to define two terms: translation and localization.

Translations enable organizations to reproduce their own words in another language. In market research, translations are a key first step to entering new markets across the world and connecting directly with a target audience in their native language.

Localization is an in-language translation process that refines and adapts content to suit the target market so that communications are tailored to the audience’s culture and local nuances. The localization process also incorporates adapting non-linguistic factors to a local market, such as imagery, iconography and currencies.

When it comes to reaching a large audience through a single language, English is the go-to as the most widely spoken language in the world. Although, with approximately

1.3 billion speakers, this reach covers just 17% of the global population.

The growth seen in non-English speaking markets provides a clear indication that market research has expanded in reach in recent years and shows no sign of slowing down. Yet without localizing materials to these markets, you run the risk of losing what could be gained from this growth. In fact, by localizing research processes to the global top 10 most spoken languages, you can expand your reach to 80% of the world.

The impact of poor (or omitted) translations

At Lucid, we’ve noticed two primary issues when translations and localizations are done haphazardly or forgone completely:

Drop rates are a direct reflection of respondent experience in a particular survey. A primary reason respondents choose to exit a survey opportunity without completing it is when the content is incomprehensible. Think about having a conversation with someone when neither of you can speak the other’s language. Tough, right?

Another reason for choosing to exit a survey opportunity without completing it is when the content is offensive. The smallest detail could alter the audience’s perception of a message; for example where a ‘thumbs up’ image may be a positive symbol in the West, in the Middle East it is considered an offensive hand gesture.

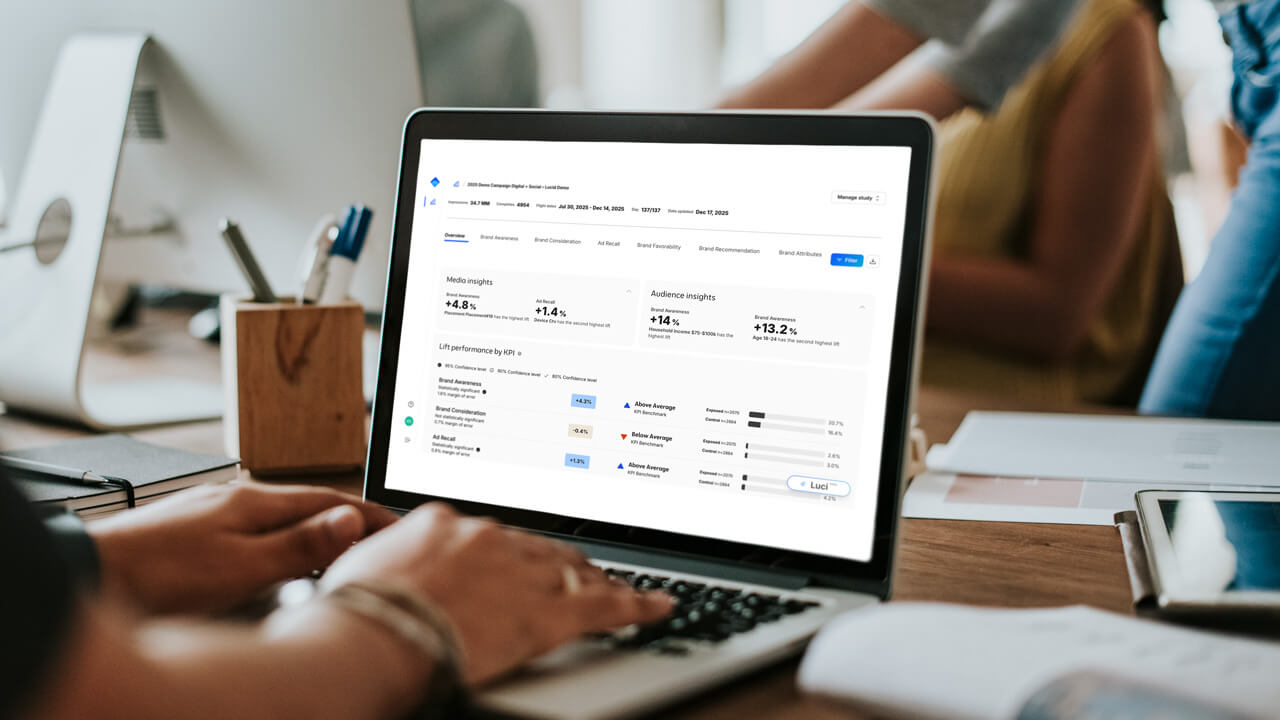

2. Data quality

For respondents that continue taking a survey without a clear understanding of the questions, data quality is at risk. Typically, respondents make assumptions and answer survey questions based on their assumptions.

When misunderstandings occur, the data gathered does not yield usable insights, and as such, the onus of data cleaning and determining if data is accurate and insightful becomes a responsibility of the researcher. Translations that are done poorly or not at all require more time in the data analysis phase of the research, and time = money.

Translations should be standard in international market research

Additionally, researchers’ decision to either include or omit translations can have a long-term impact on the industry as a whole. As insights professionals, we have a responsibility to preserve market research participants for the industry. If respondents regularly have poor survey experiences based on their inability to interpret or understand questions, they are less likely to remain engaged and active in the market research industry.

Taking care to translate and localize all forms of communication allows content to become authentic to the market and create instant customer empathy and reassurance, enabling the core message and purpose of your research to be heard loud and clear. Through Lucid’s partnership with Fluently, we ensure that each translator is not only linguistically skilled, but also based in the country to stay on top of the dialect and speaking trends. This way, you can communicate with an international audience as you would in your own native language.

At Lucid, we pride ourselves on helping researchers reach the right audiences for their questions — whether global or domestic. Our customers often have questions about which survey elements need to be tailored for specific regions. While we understand the trade-off between affordability and reach, translations are never an option in our mind! Translations are mandatory to ensure high quality and actionable insights in market research.

International survey translation best practices

Creating surveys in the appropriate language improves communication between researchers and respondents. Here are some factors to consider when creating an online survey in multiple languages:

Define your target audience

Surveys focus on getting valuable consumer data, so identifying your audience is a necessary step before translation. Develop a customer profile that outlines the attributes of the respondents you want to reach. This profile establishes important information like your audience’s:

- Country, region or general location.

- Interests.

- Occupation.

- Income level.

- Age.

Once you’ve established who you’re targeting with your surveys, use those parameters to create your survey questions.

Ensure the translation is accurate

Now that you know exactly who your target audience is, you can choose which languages you need to translate your survey to based on the demographics. When creating your survey, write your questions as concisely as possible using straightforward and unbiased language. Careful word choices will help your respondents understand your questions and give accurate answers.

Ensure you check that your translation is accurate since mistakes can make you lose credibility and trust with your respondents. Reviewing your survey translation with native speakers can help catch any issues.

Keep custom field questions to a minimum

Write most of your survey questions in multiple-choice or yes/no formats instead of customizable fields like an open-ended response. Having specific answer options reduces your translation costs and data analysis mistakes. Your respondents will also benefit from this decision, as multiple-choice options guide them to the right terminology and make the survey easier to complete.

Use graphics and visual aids sparingly

Like language, graphics need to be localized for each translation. Colors, designs, images and other visual elements have a unique meaning in various cultures. Any graphics and visuals in your survey need to be localized for each translation to convey the right meaning. It’s best to save time and effort by using graphics only when your questions need them.

Consider localization and cultural differences

When you’ve translated your survey, make sure the questions account for cultural nuances. This practice is called localization, which addresses cultural, non textual and linguistic issues in language when translating for a particular country or region.

Localization is a key consideration during translation. Your survey may go to respondents worldwide, with each individual having their own cultural background and belief system. Understanding their characteristics and language allows you to send the right message.

For example, a survey for respondents who speak British English should use the localized terms and spelling. For example, words such as “organize,” “elevator,” and “vacation” in American English would be written as “organise,” “lift,” and “holiday” (respectively) for a British English speaking audience.

Prep the translator

Even after the translator knows your target language, dialect and speaking trends, they will need more information about your survey when translating it, such as:

- Where and how you will administer your survey

- The reading level of your audience, including specific language use needs

- The original survey questions to identify translation difficulties that need clarification

- The goal of your survey so that the translator can use the correct terminology

Test your survey

Take the time to test your survey in all the languages you chose. The advantages of testing your translated questionnaire include:

- Catching and fixing flaws before the final version is sent out.

- Preserving your reputation for accurate surveys and data.

- Getting better answers from respondents.

- Drawing more accurate inferences from the responses.

Surveys are an essential part of market research. Researchers can use survey data to develop valuable insights into consumers’ behaviors, opinions, and interests. Effective survey translation allows you to collect data within a range of global markets. So, should you translate international surveys? We believe the answer is yes.

Contact us to learn more.