Contents

Categories

Navigating a volatile and uncertain era

With the economic, political, and social landscapes in an ongoing period of flux and uncertainty, decision-makers, more than ever, need access to scalable insights that shape strategy and drive decisive action.

In 2026, checking the temperature of the market and assessing consumer attitudes has become a necessity. That’s why so many researchers rely on Cint’s scale and quality of survey responses to help them validate the decisions that matter the most.

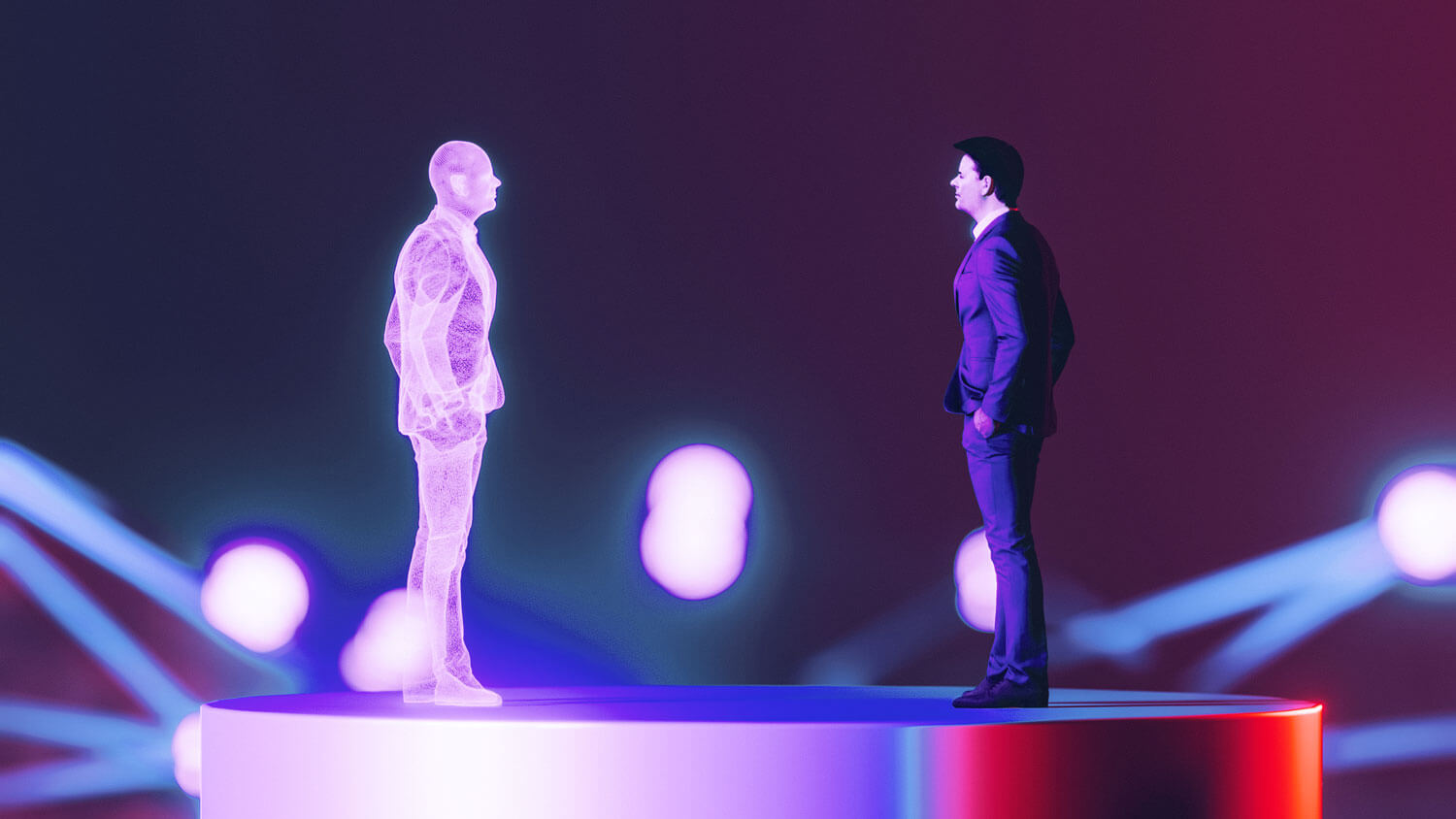

As the pace of change accelerates, the research industry is looking toward augmented methods that supplement traditional human insights. One such approach is the use of synthetic data.

Synthetic data is a means of simulating respondent behavior, attempting to create a model based on previously-accrued insights; data that has been algorithmically generated from previously captured real-world data samples.

Phil Ahad, Managing Director of Data at Cint, shares insights into the practical uses of synthetic data and explains how human expertise remains at its core.

The enduring value of quantitative research in an evolving market

At Cint, we connect researchers to millions of voices from over 130 countries around the world, delivering a truly global approach to insights.

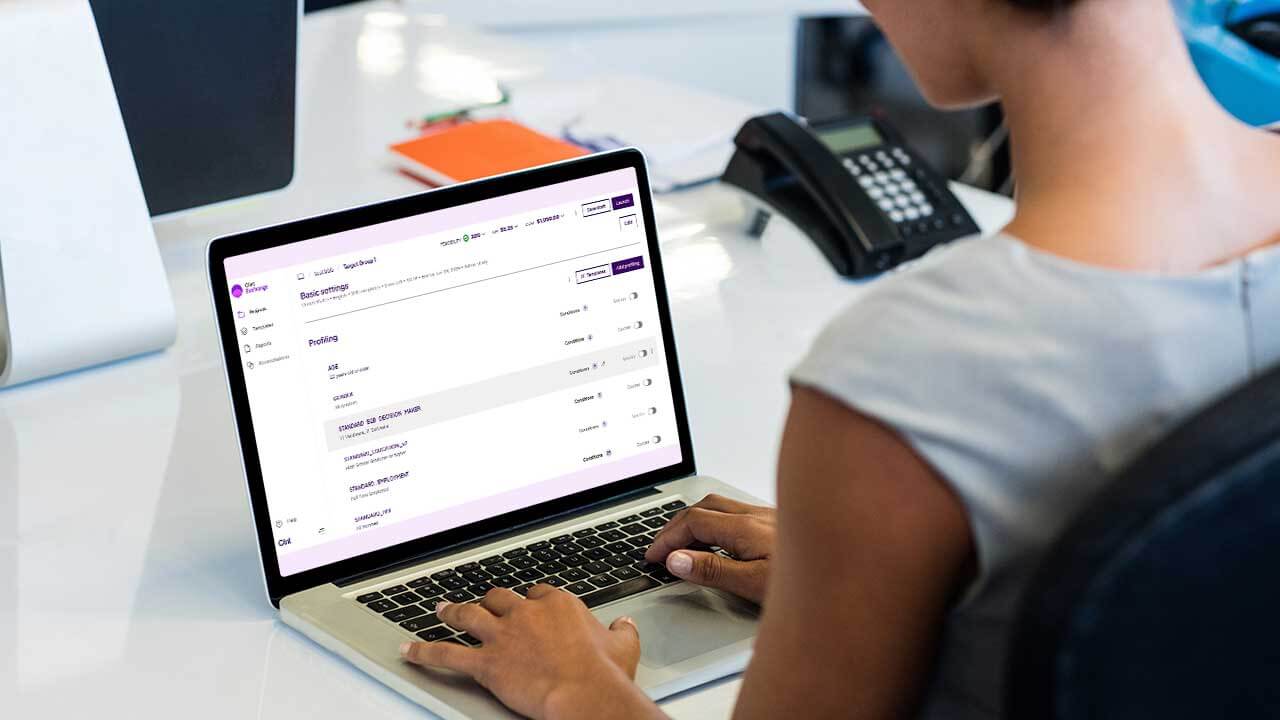

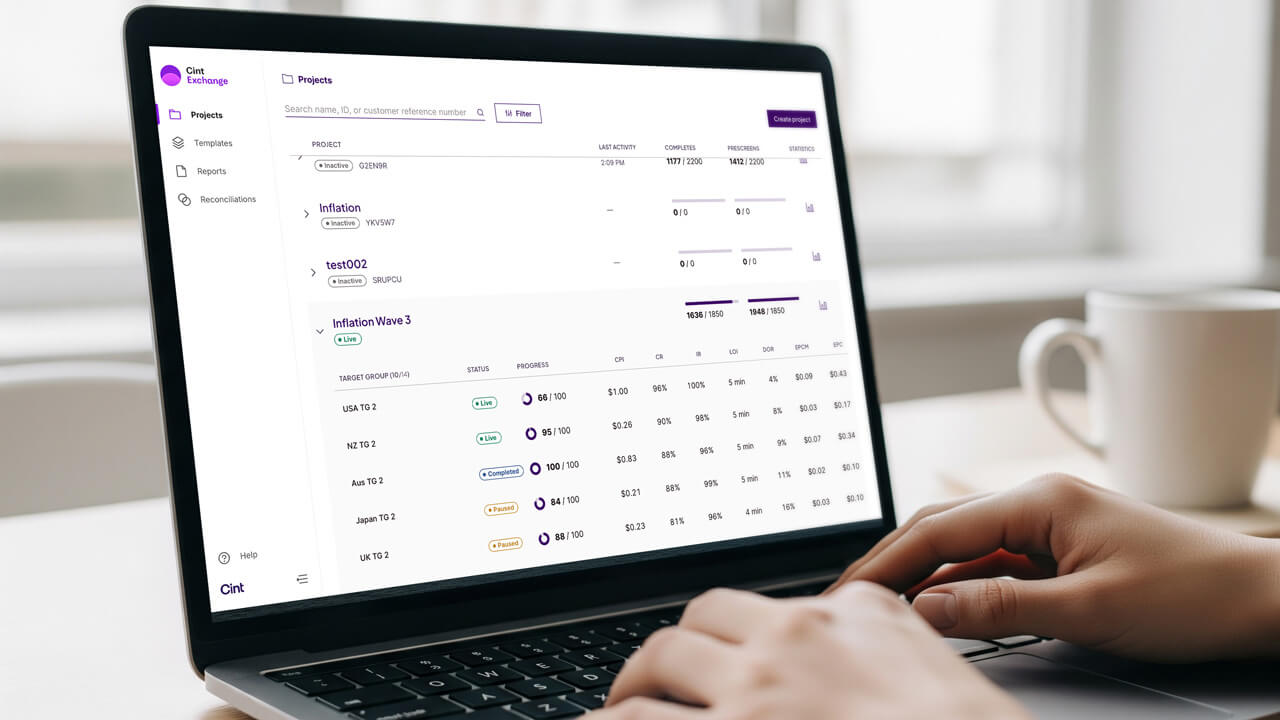

Our marketplace, the Cint Exchange, provides customers with access to over 800 large, diverse, and niche global sample providers. With Cint, you don’t just get high-quality data: you get global scale. From Austria to Zambia, Moldova to Myanmar, we connect customers to engaged global audiences ready to answer surveys.

As the world changes, so do we. Cint leverages AI across research operations, production, sampling, and quality to make quantitative research faster, cleaner, and more efficient at massive scale.

Despite those changes though, one thing remains constant: “Enterprises still need scale, consistency, benchmarking, and confidence. Those requirements do not go away,” Ahad says.

He goes on to say that it is infrastructure, not survey execution, that makes quantitative research hard to disrupt. He points to having reliable access to people, identity resolution, profiling depth, longitudinal consistency, and governance as potential stumbling blocks. As Ahad says, “Those capabilities take years to build and compound over time.”

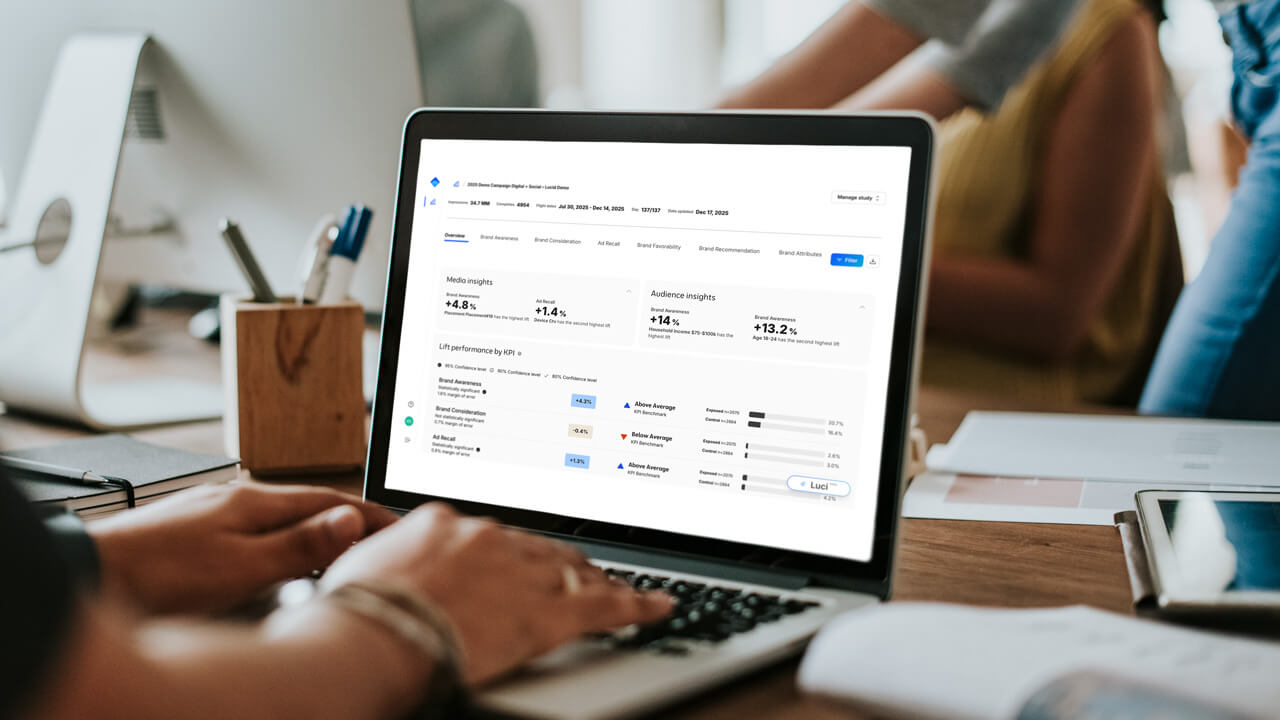

Qualitative data can explain why something might be happening; quantitative data has the ability to determine whether it matters and whether leaders can act on that data with confidence. That, Ahad says, is what makes quant foundational to enterprise decision making.

How AI can move quantitative research from automation to unblocking strategic decisions

For Ahad, increased use of AI enforces rigor at scale, with humans providing the grounding truth. Together, they produce outputs executives can rely on, explain, and defend.

“The future is a hybrid model,” says Ahad. “Humans remain the foundation of the data, but AI reduces the amount of work we ask them to do. Humans anchor reality; AI intelligently fills gaps, predicts, and synthesizes based on rich human profiles, behaviors, and historical data.”

“The future is a hybrid model, humans remain the foundation of the data, but AI reduces the amount of work we ask them to do. Humans anchor reality; AI intelligently fills gaps, predicts, and synthesizes based on rich human profiles, behaviors, and historical data.”

Phil Ahad

Managing Director of Data, Cint

Adopting a hybrid model of this kind has the potential to improve both data quality and the respondent experience. Ultimately, it delivers decision-grade insights faster and with more confidence.

“This is not about replacing humans,” Ahad says. “It is about respecting them while removing friction.”

How Cint is leveraging technological advances

Ahad was keen to stress that, “Cint is already leveraging AI across research operations and production to remove friction at scale.”

The next step for our organization is to begin actively applying AI technologies to data and insight creation in order to address what some (including Ahad) think of as the real restraint in quant: respondent burden.

Those burdens include factors like long or otherwise poorly designed surveys, which can impact respondent engagement levels.

That’s where Cint’s position is unique. “We already sit at the center of the ecosystem. We have the access, the scale, and the data depth required to move up the value chain,” says Ahad.

Read our report on AI and synthetic data usage

Want to know more about what industry professionals make of the role that synthetic data will play in the near future?