Introduction

There’s no getting around it: getting research right can be tricky.

As a global leader in online market research and measurement technology, connecting brands, researchers, academics, or anyone with a question, to a network of over 800 suppliers representing millions of engaged respondents the world over, we understand the trials and tribulations of working with respondent-gleaned insights.

“As a researcher, I am acutely aware of the challenges that the industry is facing and the pressure researchers are under to deliver fast, high-quality insights that fuel strategic decisions,” says Natasha Gay, Cint’s Senior Research Manager, Customer Insights.

“I work closely with our internal teams to bring the researcher’s perspective to our products so that we can build a marketplace that buyers trust to deliver insights any time, any place they need them, for broad and niche samples, quickly and efficiently.”

With that in mind, let’s run through a few of the more common challenges associated with fielding research and explore some of those all-important solutions.

Your gateway to hard-to-find segments and worldwide reach

Recent findings from a Cint survey show that 62% of market researchers struggle to reach diverse audiences at scale, indicating that this a problem area for the industry.

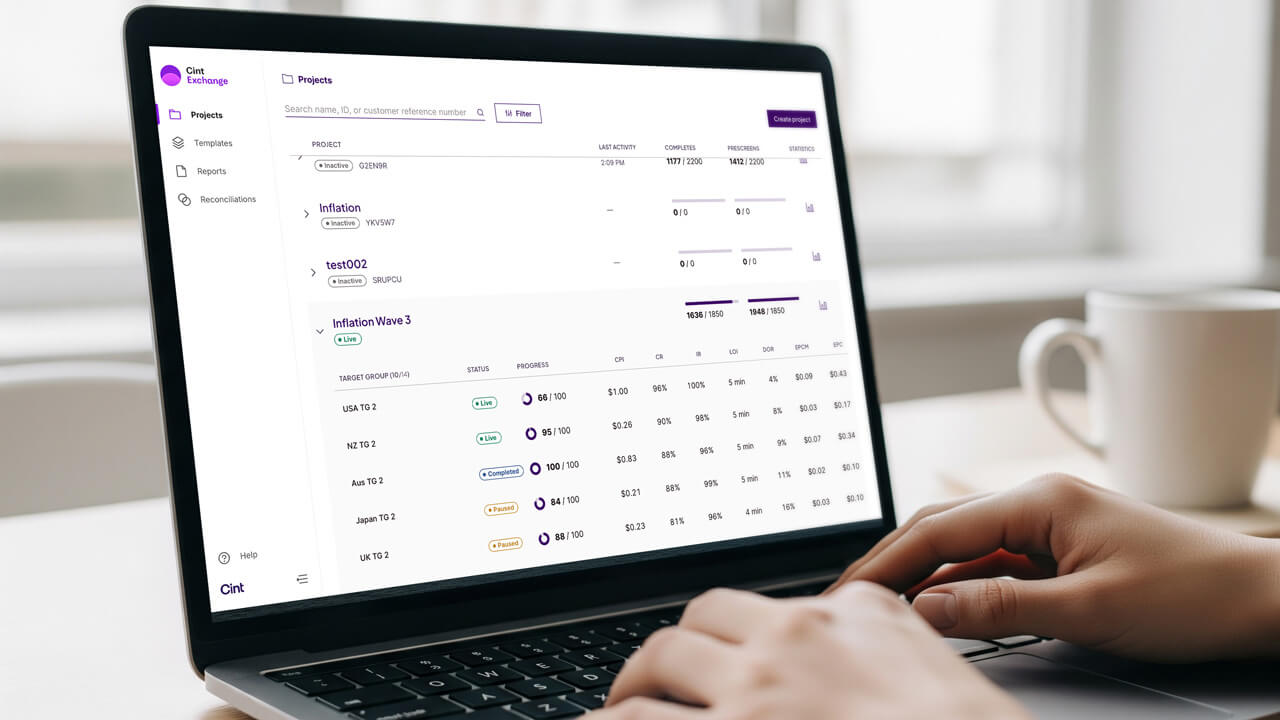

The Cint Exchange — the world’s largest online research marketplace — empowers researchers across the world to access insights quickly, and at scale. High-quality niche and global respondents alike are just a few clicks away.

Our pioneering approach to programmatic market research technology feeds the world’s curiosity.

We’ve built a marketplace around robust features that allow buyers to control their survey spend, ensuring that every project delivers a high return on their investment. When budgets are getting tighter by the quarter, and we’re all being asked to do more with less, that’s good news for everyone.

We know our customers want real responses from real people however hard-to-find they may be, and our high-quality, trusted and vetted partners ensure the authenticity of every response. This is data and research insights that you can trust — whoever you’re targeting.

Accelerate your processes to unlock sharper insights

As anyone who’s ever commissioned a survey knows, traditional market research methodologies can be laborious and time-consuming. When you need insights now, waiting around for data isn’t an option.

Cint’s approach, bolstered by innovations within the Cint Exchange, lessens the gap between the start of a survey and getting your hands on insights that help our customers build business strategies, develop research-enabled solutions, publish credible research, and more.

The Cint Exchange lessens the gap between the start of a survey and getting your hands on insights

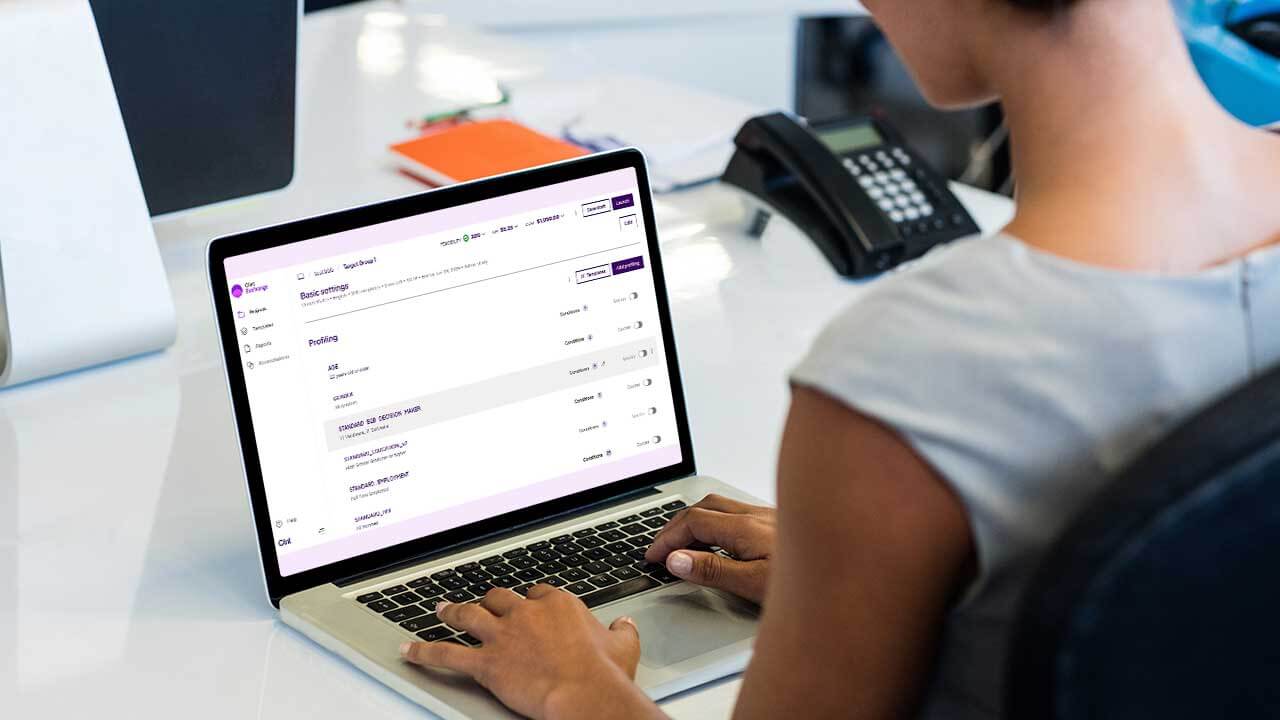

With allocation templates, for example, you can save your preferred supply settings—such as target group structure and supplier distribution—for easy reuse in future projects. This simplifies and speeds up the setup process, making it ideal for self-service users managing multiple studies.

Templates can be managed through an admin interface, where you can create, modify, or remove templates. On the target group page, you’ll find a dropdown to quickly apply saved templates or save new ones. For tracking studies, we even factor in respondents’ historical data to ensure precise and consistent targeting.

Cint Exchange customers can also save all profiling information and conditions from a target group as a reusable template, visible during new target group creation and in the Templates section under Profiling. This feature streamlines setup and boosts consistency across projects, though it’s currently limited to non-interlocked profiles.

Templates can be easily managed in the ‘Manage’ page, where users can view, rename, or delete them. Super admins can access templates for any account, simplifying oversight. Reusing templates helps reduce setup time, improves accuracy, and speeds up the path to insights.

Insights that don’t break the bank

To better understand your customers, you need data. However, as budgets continue to shrink, you’re expected to achieve more with less. That means being strategic about every dollar spent in an attempt to ensure that the data you gather has the maximum impact on decision-making and strategic planning, whatever sector you work in.

The Cint Exchange has been developed to give budget-conscious customers the insights they need at a price they can afford.

The Cint Exchange has been developed to give budget-conscious customers the insights they need at a price they can afford.

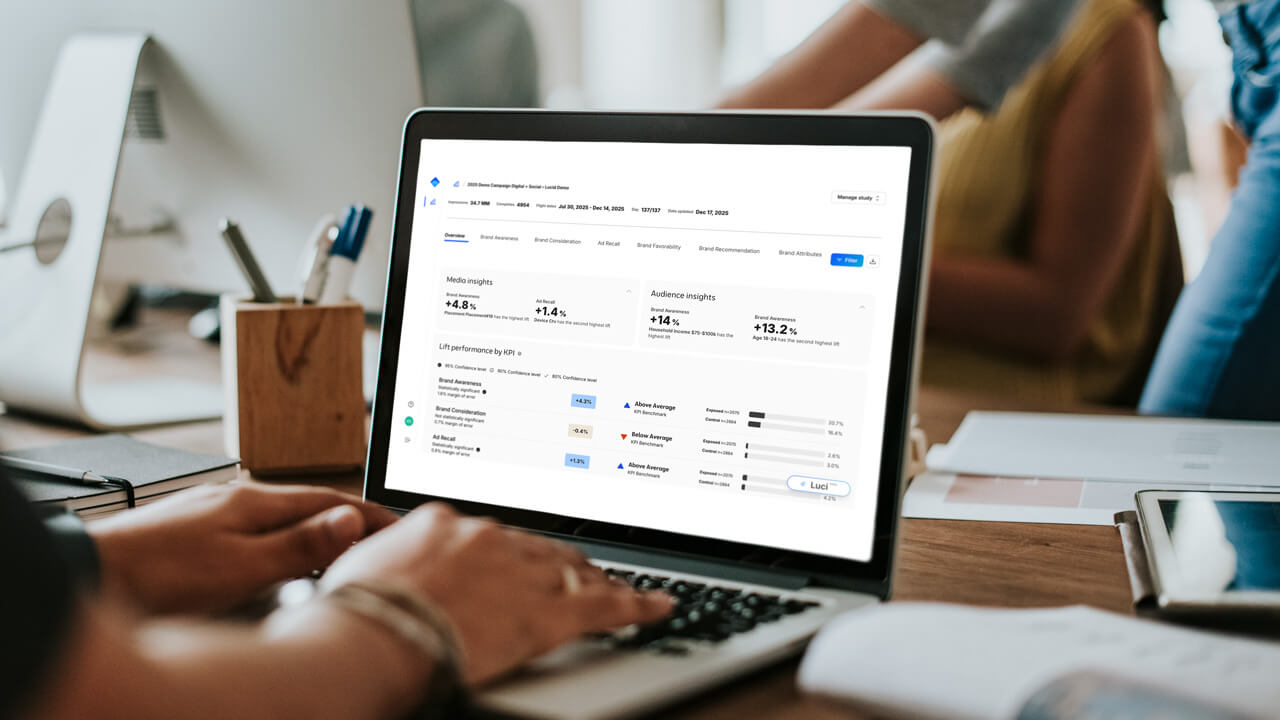

One of the ways we do this is through Automated Fielding. Cint’s Automated Fielding feature leverages AI and machine learning to improve survey performance through the optimization of how target groups are fielded. Enabled during the setup of your target audience, it’s designed to boost efficiency and ensure data quality.

With four customizable settings—Prevent Overfilling, Balanced Fill, CPI Optimization, and Complete Pacing—customers can confidently launch their project safe in the knowledge that Cint will make sure that fielding is correct. This smart automation handles the heavy lifting, reducing manual effort, controlling costs, and ensuring high-quality data delivery.

The Cint Exchange also allows customers to easily estimate their sample costs via our transparent rate cards. These rate cards factor in the Length of Interview (LOI) and Incidence Rate (IR) of a proposed survey, providing customers with access to hundreds of millions of respondents, with no long-term commitment necessary.

Enjoy pricing without markups or extra charges, and let our automated system optimize your survey fill with dynamic price adjustments.

Quality is key

Saving time and cutting costs is the goal, but the quality of your insights should never be overlooked. Bad quality data hurts. Receiving poor-quality data is not only frustrating, but it has real implications for everyone involved in the process.

Saving time and cutting costs is the goal, but the quality of your insights should never be overlooked.

Some of the potential consequences of attempting to work with poor quality data include the limiting of research insights, additional costs, and even a loss of trust.

As the market research industry at large adapts to changes and challenges within the sector, so do we. Cint’s dedicated Trust and Safety team is backed by decades of market research industry and engineering expertise to proactively address survey fraud.

As such, Cint is successfully taking decisive action against fraudulent actors who contribute to poor-quality data, seeking to exploit our platform and the entire online research industry at large. We combine advanced tech with dedicated teams to ensure real people answer real surveys.

Read more about Cint’s ongoing commitment to tackling fraud in the Restech space here.