Companies operating in the consumer packaged goods (CPG) industry face an ever-changing marketplace. Consumer attitudes shift, lifestyles evolve and you need marketing strategies that keep pace. Market research will help you do just that.

If you want to learn more about conducting market research for consumer packaged goods, continue reading our CPG market research guide.

Why Should CPG Companies Conduct Market Research?

Your business stands against several competitors in the CPG industry, many of whom share the same shelf space or land on the same search results pages as your company. Marketing is all about adding value to your customers. The more your product delights your audience, meeting their unique needs, the stronger your brand’s competitive edge will be. Conducting market research will help you determine those unique needs and how best to meet them.

Market research for CPG companies can answer questions such as how your target consumer shops, which types of packaging draw their eye the most and how satisfied they are with your product. Use market research to help your CPG company develop better products, market them more effectively and increase your sales.

The money spent on

retail e-commerce sales worldwide grew 47% from 2019 to 2021, and it’s predicted to grow another 50% by 2025. The rise of e-commerce leaves CPG companies with more customer touchpoints to juggle — and more competition. Rather than only competing for shelf space in a retail store, many brands also have to position themselves against global competitors online.

Further, customers have access to more brand information than ever before. A simple search can tell them which CPG companies align with their values — for example, whether a makeup brand manufactures its products ethically or sustainably.

Online access to brands means understanding your customers’ needs and evaluating your brand’s positioning are more important than ever. With market research, you can:

- Evaluate branding: Conduct surveys to understand how customers perceive your brand and adjust your strategies accordingly.

- Market products effectively: Understanding your audience allows you to craft marketing messages that resonate with them. You can use market research to evaluate how effective your advertisements have been and understand how to best position your product for your target audience. Market research also helps you stay on top of customers’ ever-changing shopping habits and tap into new purchase trends, such as grocery delivery apps.

- Improve product packaging: For many CPG brands, your packaging is one of the primary ways you stand out on the shelf. Even with e-commerce purchases, your packaging can delight customers. Use market research to evaluate whether your customers respond to your packaging the way you hoped and make improvements if needed.

- Integrate all steps of the purchase journey: With market research, you can get on the ground and see exactly how customers shop, make purchase decisions and even use your products. Use these insights to understand what matters to your customers when making a purchase.

- Develop products for your audience: Evaluating how customers use your products and better understanding their needs allows you to generate strong product ideas that put customers first.

- Mitigate risks with product launches: After developing new products, conduct field tests or panel interviews with potential new segments to help you better predict how well the product will perform.

- Increase customer loyalty: Conduct market research to understand how your products currently perform. What is the customer service experience like? Evaluate customer satisfaction to spot areas of improvement and keep your customers returning to your brand.

- Create a unified customer experience: The growth in e-commerce means you have multiple touchpoints with your customers. Conduct surveys or interviews to evaluate brand consistency and the user experience of online platforms.

How to Conduct Market Research for the CPG Industry

Depending on your research goals, you can conduct market research in many ways. Each method falls into one of two categories — primary or secondary research. Primary research involves gathering data specifically for your company and business goals. Secondary research analyzes existing data to gain insights. Let’s explore some of the most common types of primary research your company can conduct.

Surveys

Surveys are one of the most cost-effective and versatile types of market research. CPG companies can conduct surveys to evaluate branding, customer satisfaction and market sentiment.

To gather data from existing customers, you can include the survey link in your receipts, on the purchase page of your e-commerce site or at the end of a customer service call.

If you’re considering a new customer segment or market, you might send surveys to a representative sample.

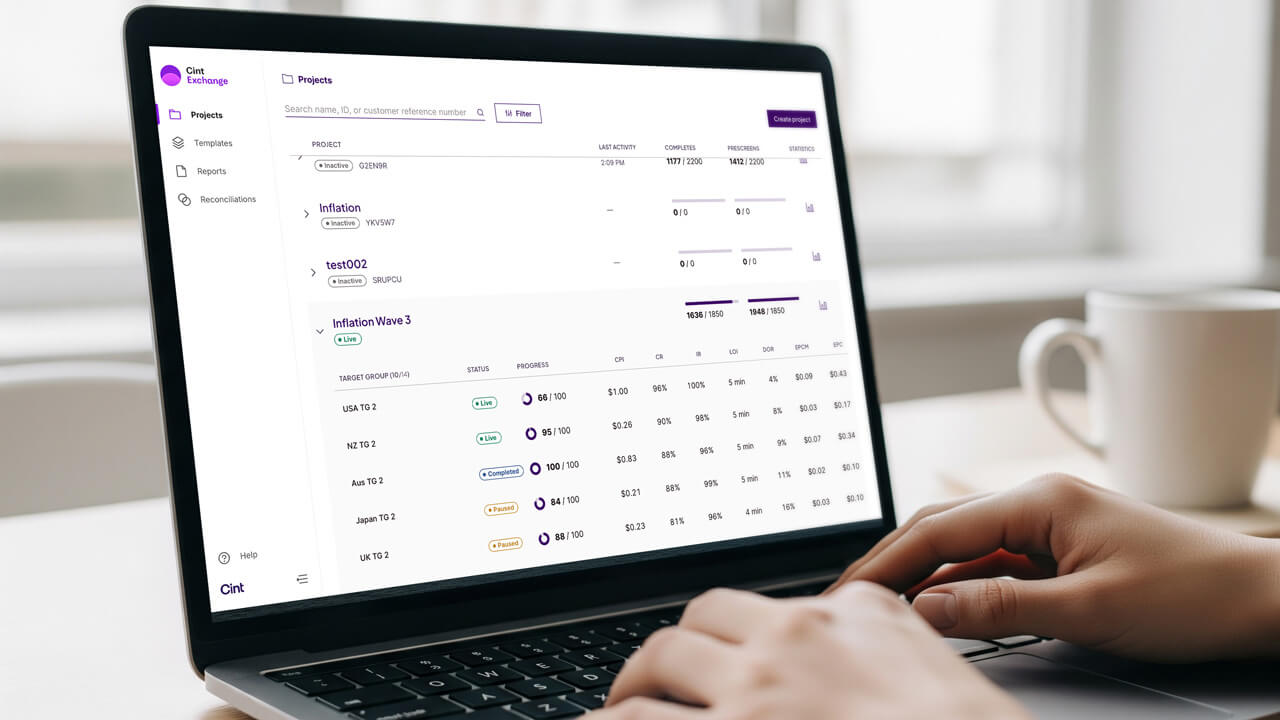

Use a sample marketplace to access these samples quickly and affordably.

Interviews

Interviews are a great way to hear your customers’ thoughts in their own words. Many interviews occur during or immediately after an interaction with your brand, meaning your company’s products are top-of-mind. For example, you can conduct a field interview as customers leave a store.

Some interview methods also allow you to place responses within the context of customer behavior. For example, you might send an interviewer on a shop-along to ask questions about the purchase process while your customers shop.

Focus Groups

Focus groups allow you to gauge customers’ reactions to new packaging, brand messaging or products. A focus group has fewer respondents than a survey, and group members interact with each other throughout. A moderator asks questions and observes participants’ reactions and verbal responses. The discussion-based nature of a focus group creates a more open environment for the respondents to air their thoughts more freely than they might in an interview.

Field Trials

While focus groups let you gauge reactions to new products or strategies pre-launch, field trials allow you to launch the new ideas in a controlled, observable way. For example, if you have a new snack product, you could launch it in a sample location to analyze its performance before launching it fully.

Observation

Focus groups and many types of interviews provide some observation, but if you want deeper insight into your customers’ shopping and product usage behaviors, consider employing an observation-centric research method. For example, you could ask participants to video themselves using a product at home. These observations can help you generate new product ideas or positioning strategies.

Eye-Tracking

CPG brands need to understand how their products perform in retail stores to make informed decisions about packaging, shelf placement and similar factors. You can use eye-tracking software to observe how customers’ eyes move along the shelves and which products catch their attention. Eye-tracking software can also analyze how visitors view your online product pages.

Factors to Consider When Doing CPG Market Research

To obtain the most useful results from your market research, keep the following factors in mind before you begin:

- Business goals: Know the types of data you want to collect and how it will impact your business goals. Even choosing which type of research to conduct depends on your research goals.

- Research budget: How much do you have allocated to market research? Which types of market research will see the most significant return on investment?

- Sampling methods: As you conduct market research, you will need to use a representative sample of your target population. Understand the various sampling methods to obtain reliable results.

- Questionnaire design: Any research technique involving questions must be well-thought-out to limit bias and get the results you need. Learn how to design an effective questionnaire before beginning your research.

Turn to Cint for Your CPG Market Research Needs

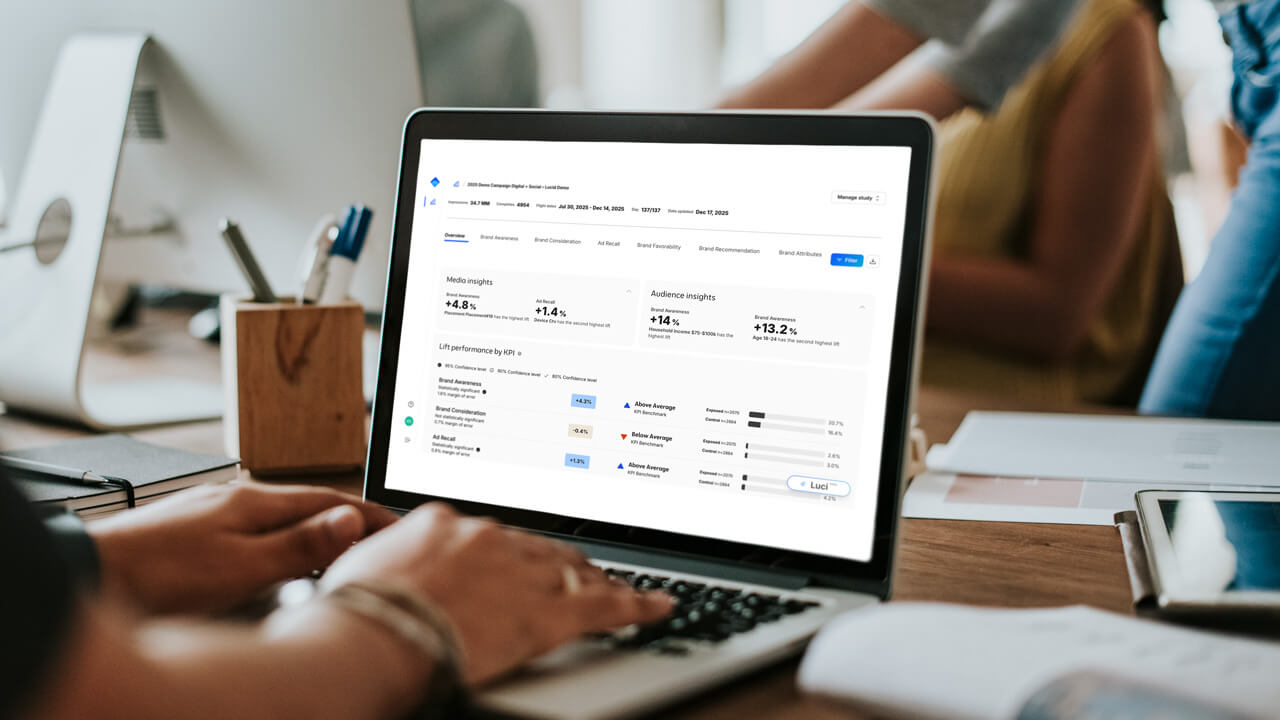

At Cint, we offer multiple tools to help your CPG company conduct effective market research. Use our online sampling platform to connect with survey respondents within your target audience. If you want to evaluate your advertising strategy, learn more about our media measurement tool. Data is critical for CPG brands to drive results and keep up with ever-changing trends.

Contact us today to learn more about how Cint’s tools can help your company deliver innovative, data-driven business strategies.

Companies operating in the consumer packaged goods (CPG) industry face an ever-changing marketplace. Consumer attitudes shift, lifestyles evolve and you need marketing strategies that keep pace. Market research will help you do just that.

If you want to learn more about conducting market research for consumer packaged goods, continue reading our CPG market research guide.

Companies operating in the consumer packaged goods (CPG) industry face an ever-changing marketplace. Consumer attitudes shift, lifestyles evolve and you need marketing strategies that keep pace. Market research will help you do just that.

If you want to learn more about conducting market research for consumer packaged goods, continue reading our CPG market research guide.