Unlocking insights into spending habits for Valentine’s Day 2024

From the original tradition of sending handmade cards, Valentine’s Day has transformed into a commercialized holiday over the past decades, synonymous to a day of lavishing gifts on loved ones. The National Retail Federation survey predicts that consumers are to spend an eye-watering $25.8 billion in 2024, with confectioners and florists slated to take the lion’s share. We used CintSnap – a way to survey individuals and understand opinions quickly – to find out how people in the United States and the United Kingdom approach this romantic season, by surveying approximately 300 people from both sides of the Atlantic. Of the people we polled, a significant 70% of Americans are gearing up to celebrate, compared to 59% in the UK. What are their spending habits, preferences, and plans? We go into more detail below.

Hey big spender?

Money talks, especially on Valentine’s Day. In the US, the majority or people polled (72%) plan to keep their spending under $100, with 21% willing to splurge over $100. Similarly, in the UK, 61% aim to stay within £100, with 26% opt not to spend anything at all and only 12% going over £100. The sentiment remains consistent: most prefer to cap spending at a modest amount. Would inflation affect spending decisions this year compared to last Valentine’s? Respondents seemed to think so, with 62% (US) and 57% (UK) respondents claiming to be very likely or somewhat likely impacted by price increases in goods and services. And what did consumers think of Valentine’s Day sales? Only 22% of people polled in the US said they would not be taking part in them. However, the reverse sentiment was expressed in the UK with 45% preferring to abstain from sales which may suggest a stronger disdain for commercialism compared to their American counterparts.Roses are red, violets are blue...

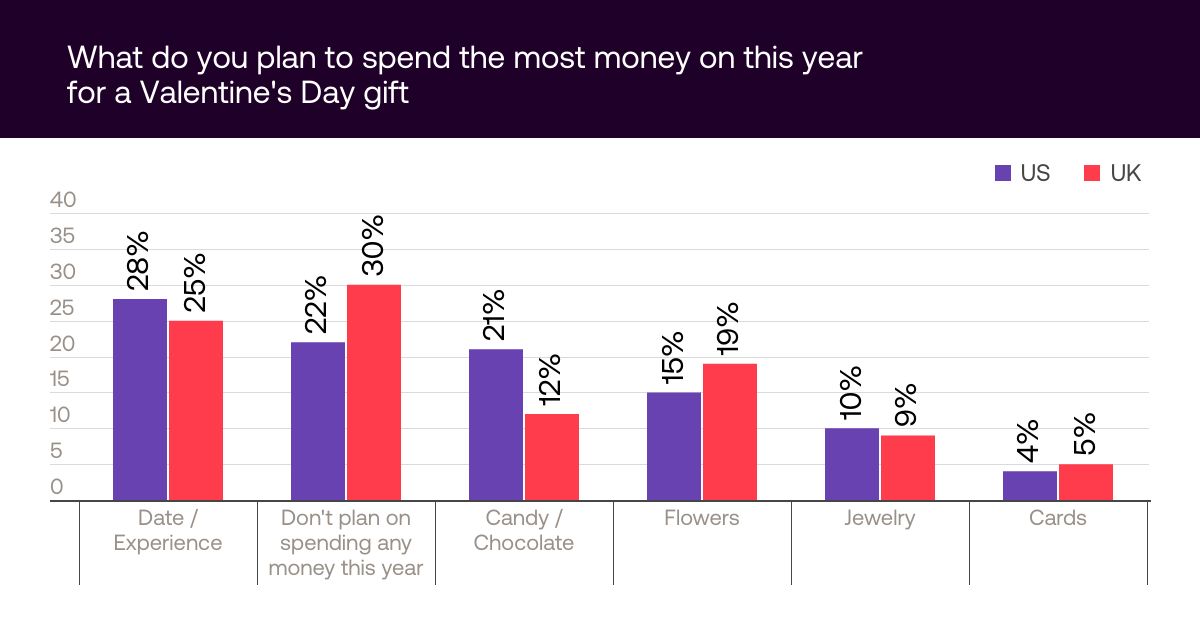

...but who needs flowers, when I have you? When looking at what consumers were splurging on, dates or experiences trumped actual gift-giving, and came out top for both countries. In the US, 28% prioritize a date or experience, closely followed by 21% opting for candy or chocolates. Meanwhile, in the UK, 25% prefer a date or experience, with 19% opting for flowers. Both jewelry and cards ranked low on the gift hierarchy in both regions. Of the activities that couples planned to engage in, a romantic restaurant dinner topped the list for respondents in the US at 41%, meanwhile in the UK, 38% preferred a cozy night at home, with restaurant dates slightly behind at 34%.

The object of affection

Our survey also investigated who consumers were spending on. While popularity of Galentine’s celebrations have picked up over recent years, unsurprisingly, it was still significant others that took the center stage in both the US (53%) and the UK (57%). A notable percentage in both regions opt not to spend on anyone at all, followed by spending allocations for children, self-indulgence, and friendships.Shopping preferences and inspiration

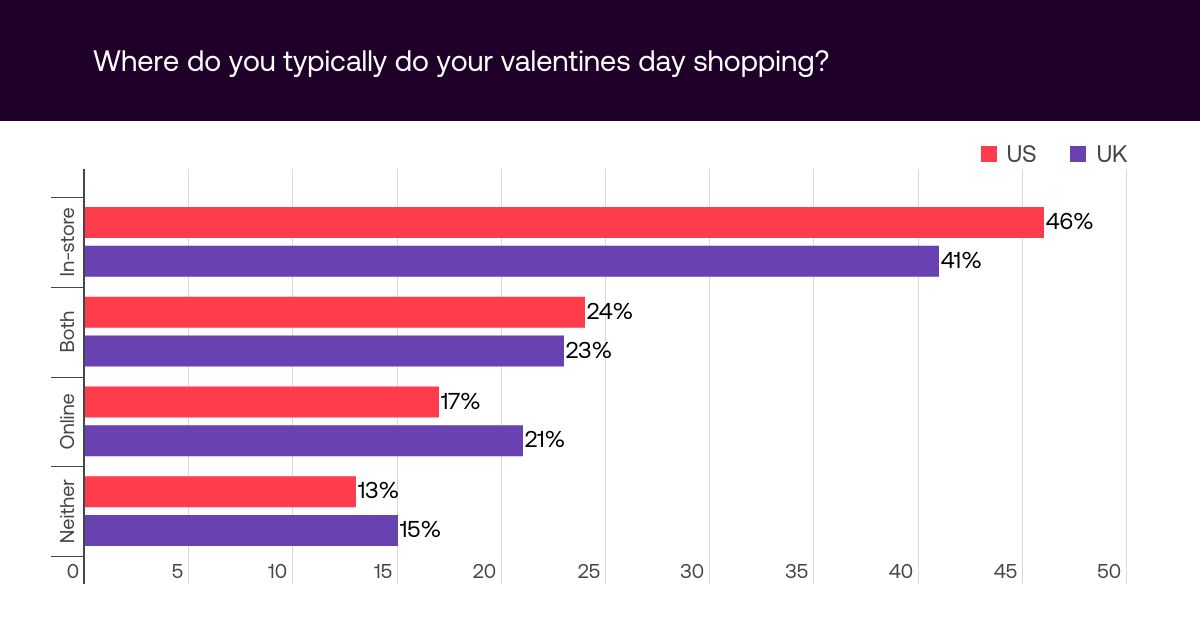

Brick-and-mortar or online stores? Where do consumers prefer to make their purchases? In-store shopping maintains its stronghold in both regions, with 46% favoring this traditional approach in the US and 41% in the UK. Online shopping followed strongly behind, indicating a healthy balance of traditional and digital experiences for the retail landscape. When it came down to inspiration for shopping, friends and family emerged as the primary influencers in both regions, with TV ads also exerting a strong sway. Emerging platforms like TikTok and influencer marketing on social media also proved to be gradually making their mark on consumer behavior.

Will you be celebrating Valentine’s Day this year, and if yes, how do you plan to mark the occasion? Join in the conversation on our LinkedIn page.

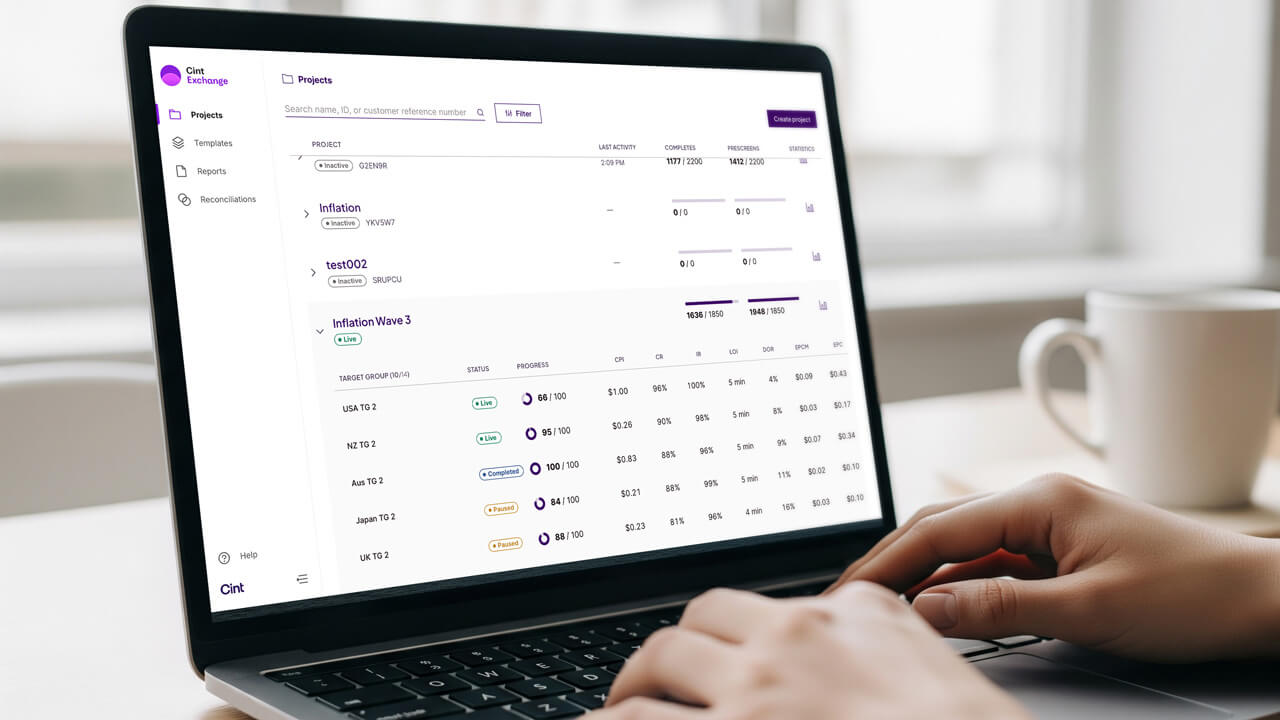

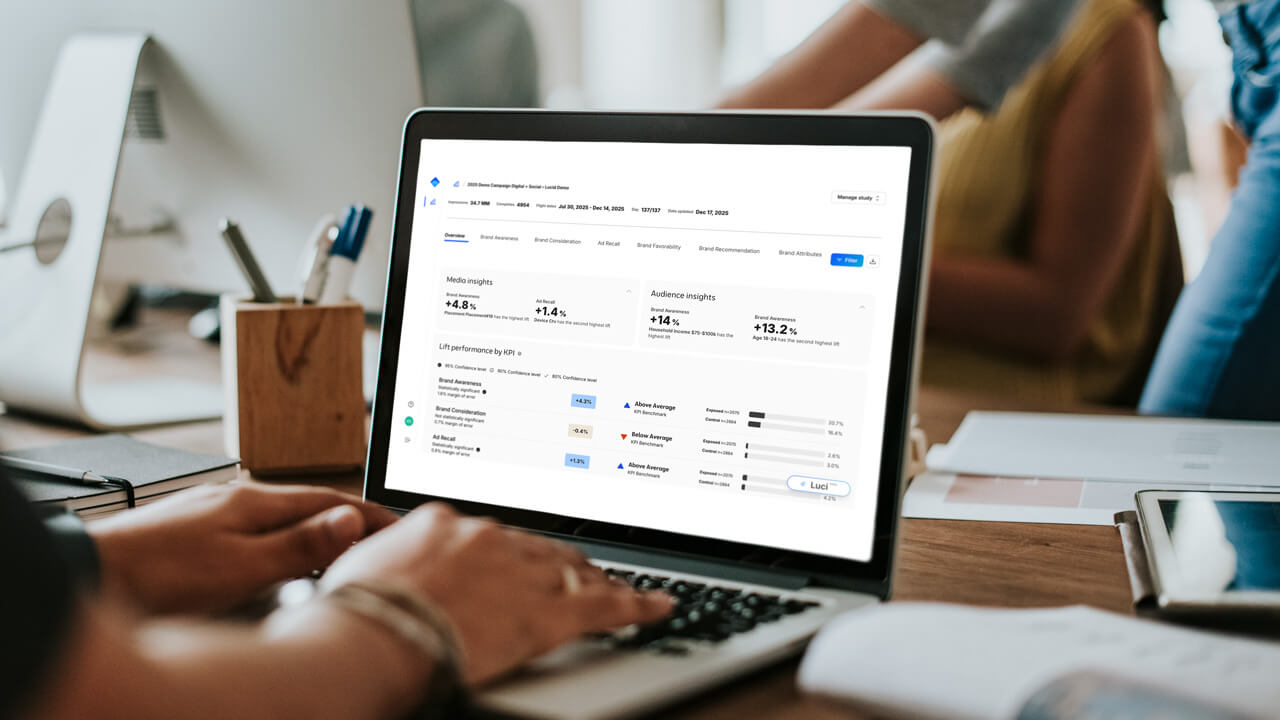

Cint’s research technology helps our customers to post questions and get answers from real people, in real time – and to use these insights to build business strategies, publish research, and accurately measure the impact of advertising efforts. Find out more here.

When it came down to inspiration for shopping, friends and family emerged as the primary influencers in both regions, with TV ads also exerting a strong sway. Emerging platforms like TikTok and influencer marketing on social media also proved to be gradually making their mark on consumer behavior.

Will you be celebrating Valentine’s Day this year, and if yes, how do you plan to mark the occasion? Join in the conversation on our LinkedIn page.

Cint’s research technology helps our customers to post questions and get answers from real people, in real time – and to use these insights to build business strategies, publish research, and accurately measure the impact of advertising efforts. Find out more here.