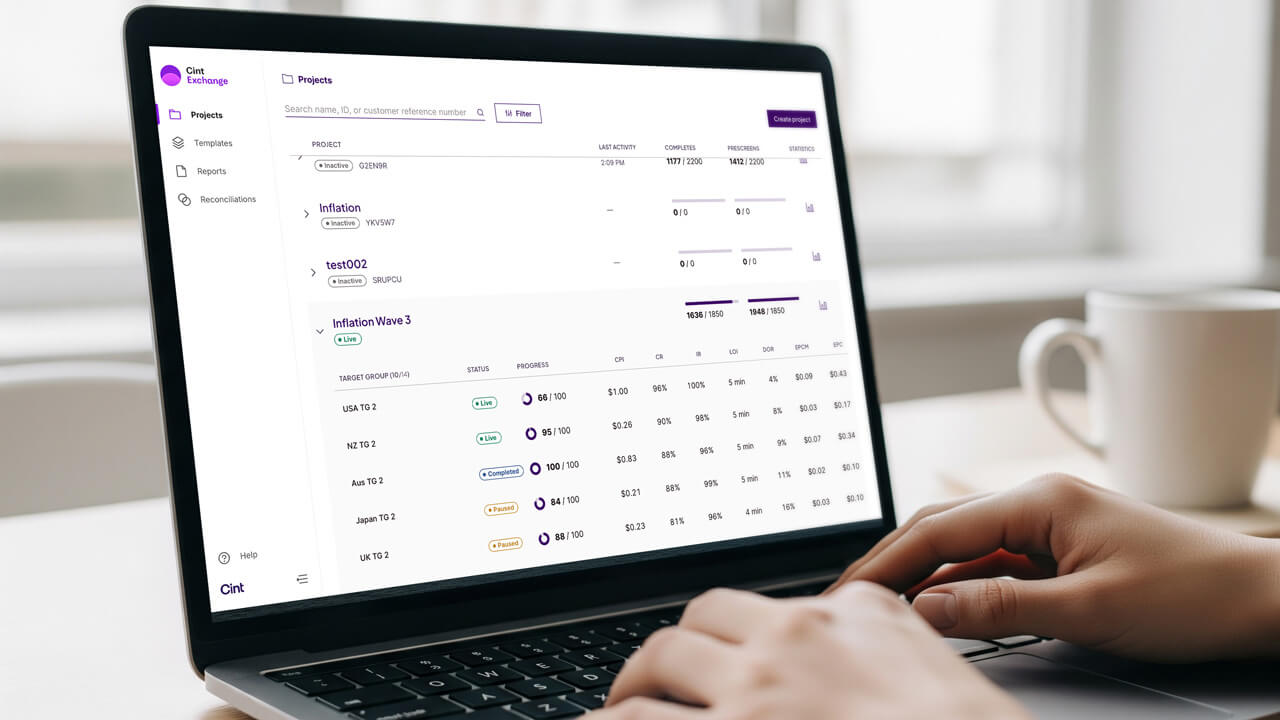

Cint Platform Data Shows No Significant Impact (Yet) of Coronavirus on Industry Supply and Demand

As the largest of the industry’s sample exchanges, we have the enviable position of being able to witness the ebb and flow of market research supply and demand. We are sharing this data to provide greater understanding of the impact of the pandemic for decision-makers on both sides of the market research “transaction.” For our thoughts on the impact of COVID-19 on consumer behaviour, please see our Research Note 1: Monitoring Changes in Consumer Behavior Due to COVID-19Background

The rise of the COVID-19 and the subsequent “lockdown” of whole populations is expected to negatively impact the global economy. The big unknown is how long this will last. Decreased movement is driving down consumer spending. Companies are starting to retrench by scaling back expenses. Now, everyone is asking questions that revolve around the impact of the virus on supply and demand in market research.Demand and Supply: The Market Research “Transaction”

To borrow from the terminology of economics, the market research transaction has two parts. Demand in our industry is reflected in a brand or company’s desire to learn more about consumer behavior. We can measure demand as a simple function of the number of consumers from whom these firms wish to collect behavior or opinions. We can express this as we might a consumer packaged good, by looking at the number of projects run and the number of completes per project. Supply is measured by the number of respondents available, though in today’s world the concept of invitations and response rates is increasingly archaic. At Cint, we do have invite-driven suppliers on our platform, but we have more supply that is programmatically driven. For the latter, we can look at entries into the platform. (An entry is effectively a programmatic respondent being sent from a supplier and touching our platform.) Ultimately, demand and supply meet at the point of the interview and subsequent complete.Hypotheses

To study the impact of the virus on our industry, we are looking at both demand and supply factors. As researchers, it helps us to state hypotheses to ensure that (a) we have a comprehensive view on the situation and (b) we have clear indicators by which we can gauge impact. Demand hypotheses:- Clients reduce MR spending, resulting in fewer projects commissioned.

- Clients reduce MR spending, resulting in fewer projects and fewer completes per project.

- Respondents become less/more likely to participate in research studies, causing their numbers to decrease/increase, as measured by either:

- a decline/increase in the number of programmatic entries to the platform;

- fewer/more respondents to email invitations; or

- lower response rates (respondents divided by invitations).

- For whatever reason, conversion rates decline. (Conversion rate is defined as the number of completes divided by entries, which takes into account all factors that stand between a respondent and her/his desired outcome of completing a study).

- For whatever reason, dropout rates increase. (Dropout rates are the number of people abandoning a survey divided by entries. Dropout is typically a function of a terrible experience that is survey-related.)

Results

We have selected a handful of countries for this analysis. Charts are available in PDF format showing various metrics graphed alongside daily figures of confirmed COVID-19 cases. In every chart, we have deleted the vertical axis labels for confidentiality. In some charts, we have also re-scaled the data. In every chart, the COVID-19 cases are reflected on the secondary (right-hand) vertical axis. An example of these charts is shown below. These are programmatic entries and respondents from the United States. Below are the results through March 30:

Below are the results through March 30:

- FR/US/JP: No apparent impact so far on any measures.

- ES/IT: Email respondents have declined somewhat, but programmatic entries have risen. Overall no impact on completes. No impact on other measures.

- UK: Could be trending lower. Entries and respondents showing a slight drop. Completes were down slightly but this could be levelling off. Completes per offer and invites sent are trending down slightly.

- DE: Respondents, completes, and projects are starting to drift downward.

- AU: Increase in number of projects, though a bit of a decrease in completes per project. All other metrics stable.

- KR/CN: No apparent negative impact, which is interesting because these countries are on the downside of the contagion curve.

- IN: No apparent effects. While response rate is declining, both the number of invites and respondents are growing. The former is growing faster than the latter.

COVID-19 impact tracking

- Cint Platform Metrics – United States

- Cint Platform Metrics – China

- Cint Platform Metrics – Italy

- Cint Platform Metrics – United Kingdom

- Cint Platform Metrics – Germany

- Cint Platform Metrics – France

- Cint Platform Metrics – Spain

- Cint Platform Metrics – India

- Cint Platform Metrics – Australia

- Cint Platform Metrics – South Korea

- Cint Platform Metrics – Japan

Written by: JD Deitch (COO at Cint)

Read our other Research Notes:

- Research Note #3: Moving Your Offline and F2F Research to the Internet?

-

Research Note #2: Is COVID-19 impacting Market Research Supply and Demand?

-

Research Note #1: Monitoring Changes in Consumer Behaviour Due to COVID-19